🚀 Acquire Founders & Investors with LinkedIn Outreach for Startup Fundraising Platforms

Done-for-you LinkedIn Lead Generation system tailored for fundraising platforms, accelerators, and venture networks. Use AI-powered LinkedIn Outreach to attract startups, book investor calls, and scale partnerships. Free Custom Report (worth $100) included.

Claim Free Report Book a Free Strategy Call✅ Who Is This Outreach Strategy Built For?

- Fundraising Platform Founders: Acquire high-quality startup and investor leads without depending on paid ads or slow referrals.

- Investor Relations & Partnership Managers: Start meaningful conversations with founders, angel investors, and VCs through personalized LinkedIn automation.

- Accelerators & Venture Platforms: Run outreach campaigns to attract startups across fintech, SaaS, healthtech, and consumer sectors — and validate messaging quickly.

- Crowdfunding & Angel Networks: Position your platform as the go-to choice for founders and backers, landing more discovery calls and deal flow.

🎯 What Makes LinkedoJet Different from Other Outreach Tools for Fundraising?

- No spam — every LinkedIn message is personalized using AI and context from startup stage, sector, or funding activity

- Designed specifically for fundraising platforms, accelerators, and venture ecosystems

- We combine ICP targeting, investor/founder segmentation, and live campaign feedback — not just automation, but a complete lead generation system

- Focus on relationships — warm introductions that convert into pitch meetings, investments, and partnerships

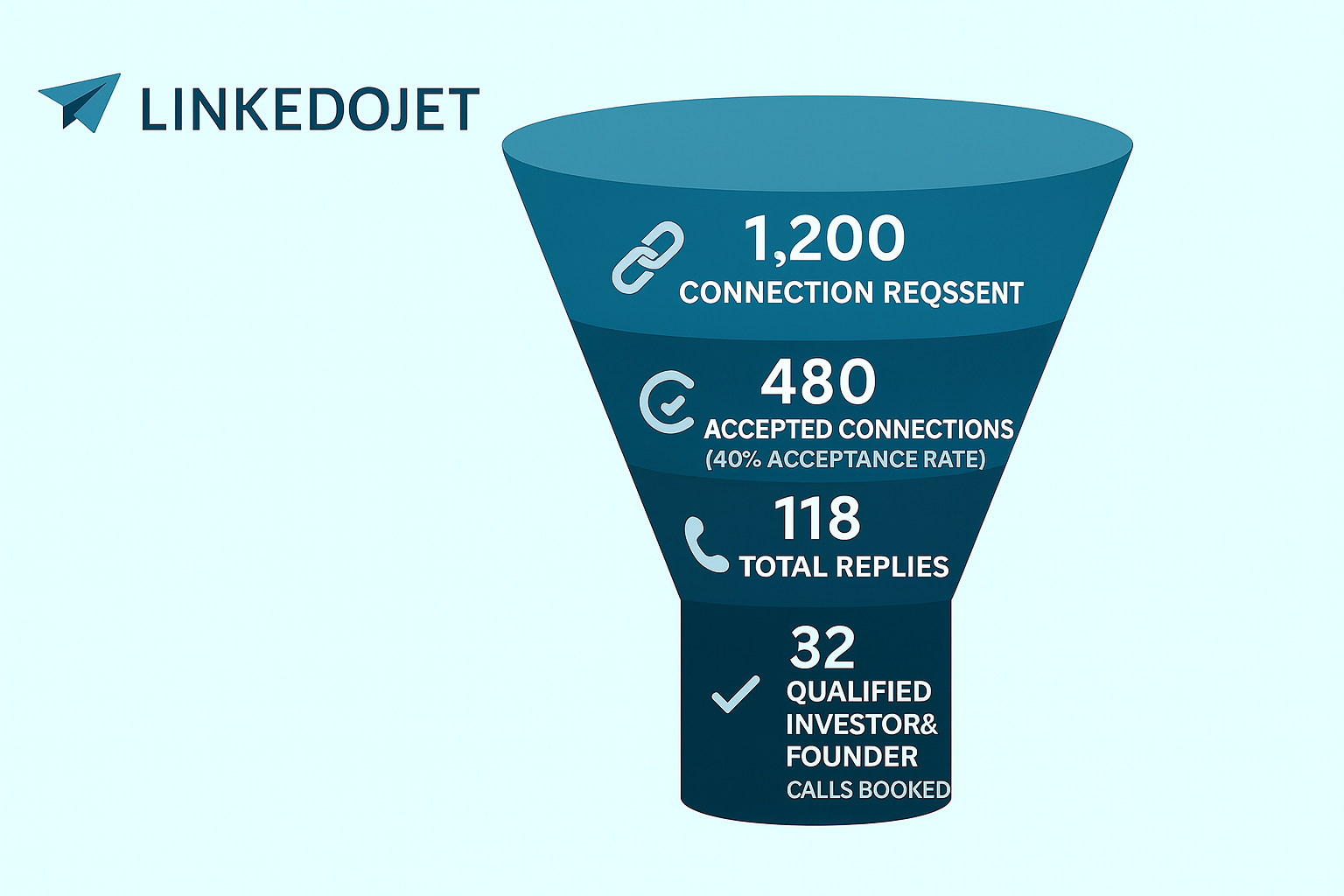

📈 Early Campaign Results

- 🔗 1,200 Connection Requests Sent

- ✅ 480 Accepted Connections (40% acceptance rate)

- 💬 118 Total Replies (9.8% reply rate)

- 📞 32 Qualified Investor & Founder Calls Booked

- 🧳 Most Interest Shown In: Pre-seed & Seed Fundraising, VC Partnerships, Crowdfunding Campaigns

- 🌎 Top Responding Regions: USA, UK, UAE, India, Singapore

Why Deeply Personalized LinkedIn Outreach Works

- Direct access to decision-makers: Reach founders, angel investors, and venture partners directly on LinkedIn — no cold calls, no gatekeepers.

- Conversations > Cold Pitches: Smart LinkedIn Outreach sparks interest, builds trust, and opens fundraising doors without feeling “salesy.”

- Fast feedback loops: Learn quickly if your pitch resonates with startups or investors — and refine based on real responses.

- Turn prospects into promoters: A single positive interaction can lead to investor referrals, founder recommendations, and long-term platform growth.

AI-Powered Personalization — Beyond Templates

Modern LinkedIn Automation for fundraising platforms goes beyond generic templates. It crafts investor- and founder-focused messages that align with each stage of the fundraising journey, using AI to power intelligent LinkedIn Lead Generation.

With OpenAI & Gemini, LinkedoJet analyzes job roles, funding activity, and content shared to deliver truly 1:1 outreach that resonates and converts.

- Role-Specific Messaging: Speak differently to a VC partner, angel investor, or startup founder — AI understands that nuance.

- Activity-Based Triggers: Reference recent funding news, pitch events, or founder posts for hyper-relevant outreach.

- Funding Intelligence: Personalize based on round type (pre-seed, seed, Series A), investor focus, or founder milestones.

- Natural Language Tuning: Messages don’t feel “AI-generated” — they feel researched, human, and timely.

📌 Platform Example: FundBridge – Connecting Startups & Investors

🏢 Company Overview

Name: FundBridge

Category: Startup Fundraising Platform

Founded: 2023

HQ: London, UK

Website: fundbridge.io (fictional)

What it does: Matches early-stage startups with angels, VCs, and crowdfunding investors using curated deal flow.

🎯 Ideal Customer Profile (ICP)

Persona: Daniel Kim – Angel Investor

Target Companies: Pre-seed & Seed startups in SaaS, Healthtech, and Fintech

Regions: USA, UK, UAE, Singapore, India

Main Challenge: Too many unqualified pitches, lack of trust-building before investment discussions

📬 Value-Driven Outreach Sequence (Soft CTA Style)

“Most investors I speak with aren’t short on pitches — they’re short on qualified deal flow that saves time.”

Just starting a conversation — no pitch.

“Only 8% of startups raise from angels or VCs — the rest fail due to poor targeting and positioning.”

Shares a short “Investor-Readiness Checklist.”

“A founder’s story matters as much as metrics — yet most platforms miss that human connection.”

A reflective observation, not a pitch.

Helped a healthtech platform reduce investor screening time by 37% with smarter outreach filters.

“Are your startup deals investor-ready?” — 2-min founder checklist shared. No strings attached.

📌 Outreach Example: FundBridge – Investor & Founder Flow

🎯 Ideal Customer Profile (ICP)

Name: Daniel Kim

Role: Angel Investor

Company: Independent investor with portfolio across SaaS & Healthtech

Challenges: Wasting time on unqualified pitches, lack of trusted deal flow

💬 Message 1: Curiosity-Driven Connection

“Most investors I know don’t need more pitches — they need better ones.”

📊 Message 2: Value Drop via Stat

“92% of startups fail to raise because they target the wrong investors.”

🧠 Message 3: Emotional Resonance

“The best pitches don’t start with decks — they start with authentic conversations.”

📚 Message 4: Transformation Story

Helped streamline a VC’s pipeline by cutting 100+ unqualified intros per month.

✅ Message 5: Free Checklist + Soft CTA

“Investor-Readiness in 5 Steps” — quick audit shared with founders to prep them better.

This outreach flow reflects the LinkedoJet principle — start with curiosity, add value through insight, and only introduce a CTA when trust is built. It’s a structured path that works for both investors and founders.

🎯 Key Benefits of Personalized Outreach for Fundraising Platforms

🚀 Attract the Right Founders & Investors

Directly reach startup founders, angel investors, and VCs — the people who actually say “yes” to pitch calls, fundraising campaigns, or platform sign-ups.

💬 Start Conversations That Drive Capital & Growth

Forget cold fundraising spam. Our LinkedIn Outreach opens trust-based conversations around funding rounds, investor opportunities, and founder needs.

📈 Validate Deals & Partnerships Faster

Stop guessing. Use LinkedIn Lead Generation to test which investor types and founder profiles respond best — refining your strategy with real market feedback.

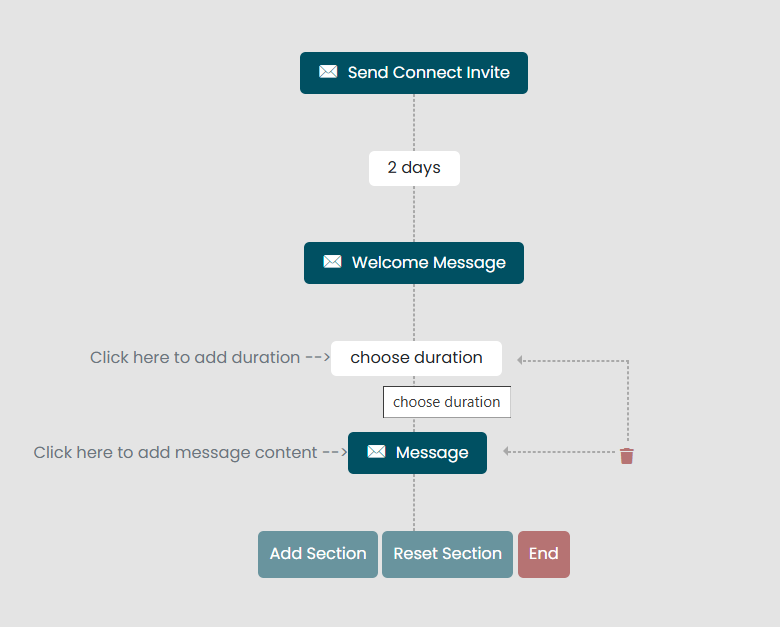

🔁 The Outreach Flow — From Connection to Capital

❓ Frequently Asked Questions

Do I need a big budget?

No. You don’t need paid ads or expensive SDR teams. Our LinkedIn automation system is lean, targeted, and optimized for startup fundraising outreach.

How long until I see results?

Most fundraising platforms see investor replies, founder sign-ups, or partnership interest within 7–10 days of launching campaigns.

Is this just another cold message template?

Definitely not. Every message is AI-personalized using role, funding stage, and recent LinkedIn activity — no generic spam.

What kind of platforms does this work best for?

Accelerators, venture platforms, crowdfunding sites, and angel/VC networks looking to generate consistent LinkedIn leads from both startups and investors.

What if I’m not sure who my ICP is?

That’s actually perfect. LinkedoJet helps you test multiple founder and investor segments quickly — using live responses instead of assumptions.

How is LinkedoJet different from tools like PhantomBuster or Dripify?

Those tools only automate. LinkedoJet is a full LinkedIn lead generation system — combining ICP targeting, AI messaging, consulting, and live campaign support in one dashboard.

📚 How to Use Your Free LinkedIn Outreach Report

- Review your tailored ICP segmentation (founder roles, investor types, sectors)

- Apply filters in LinkedIn Sales Navigator

- Use the 4-message outreach flow provided

- Track replies, adjust targeting, and iterate — feedback fuels growth

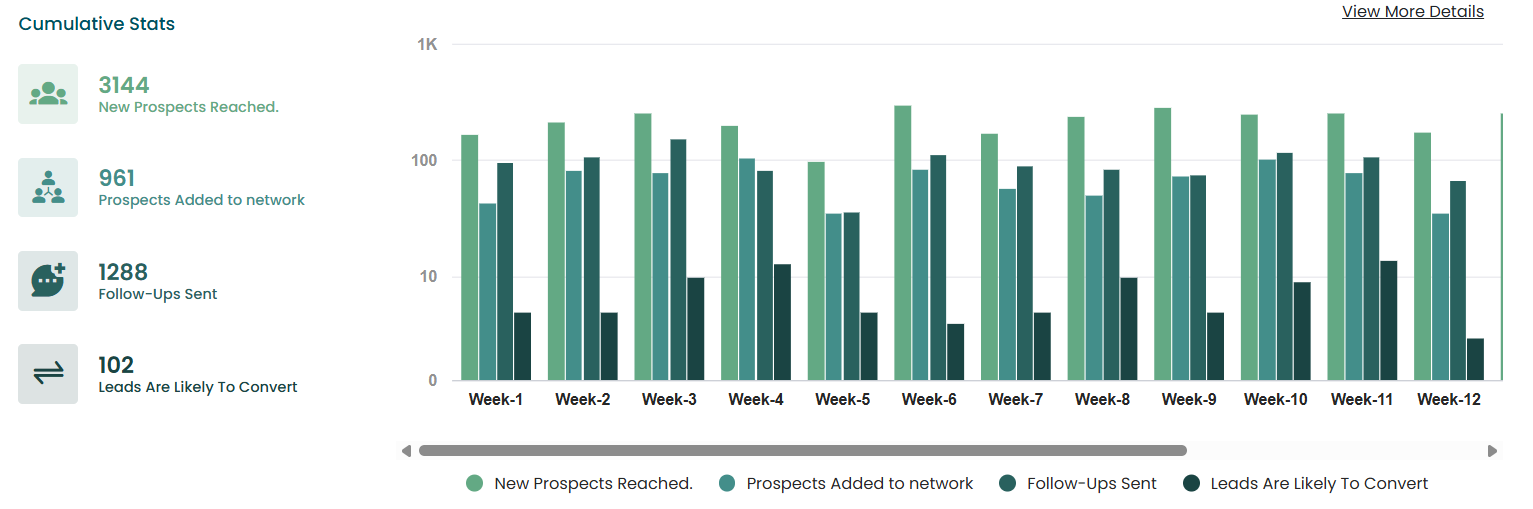

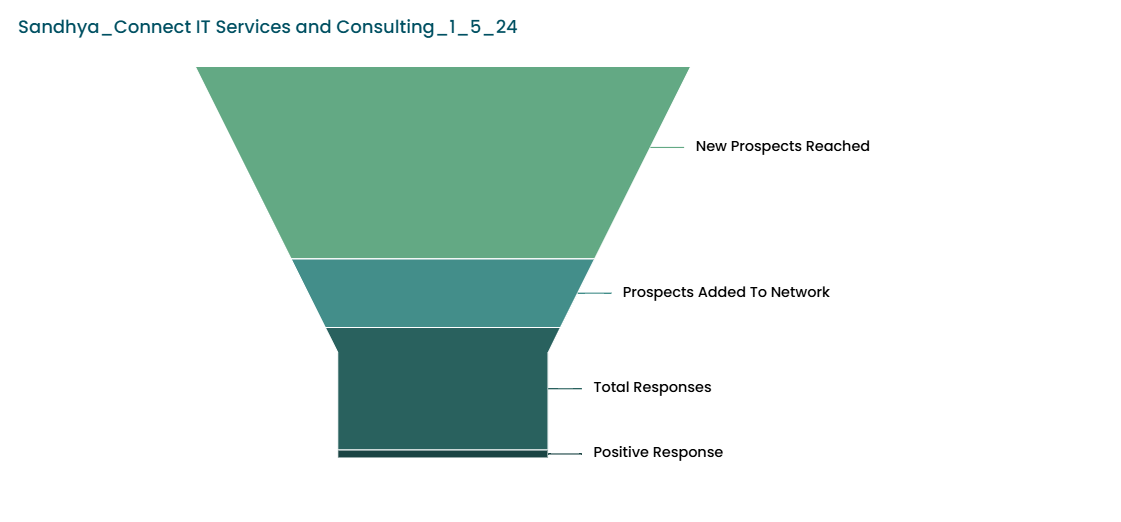

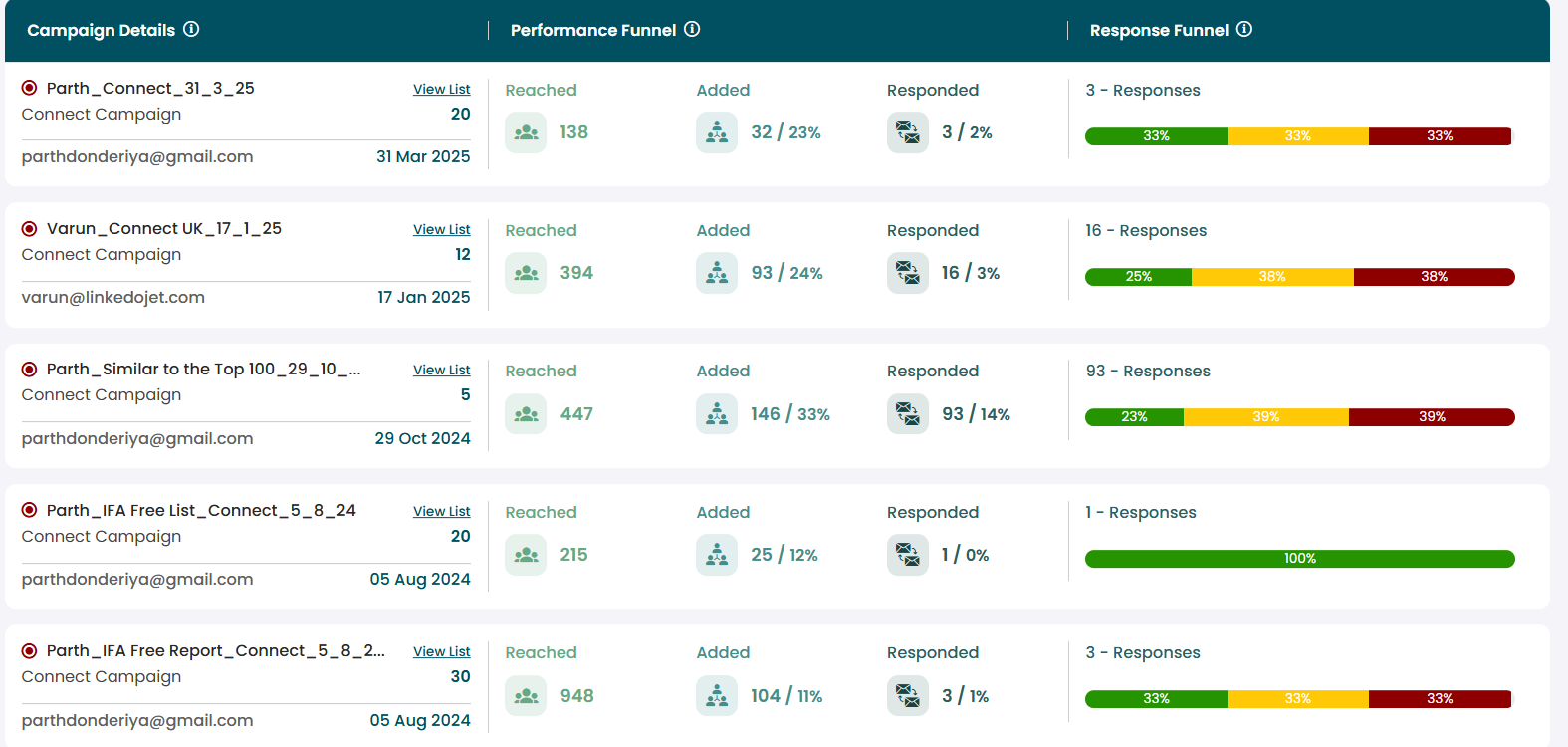

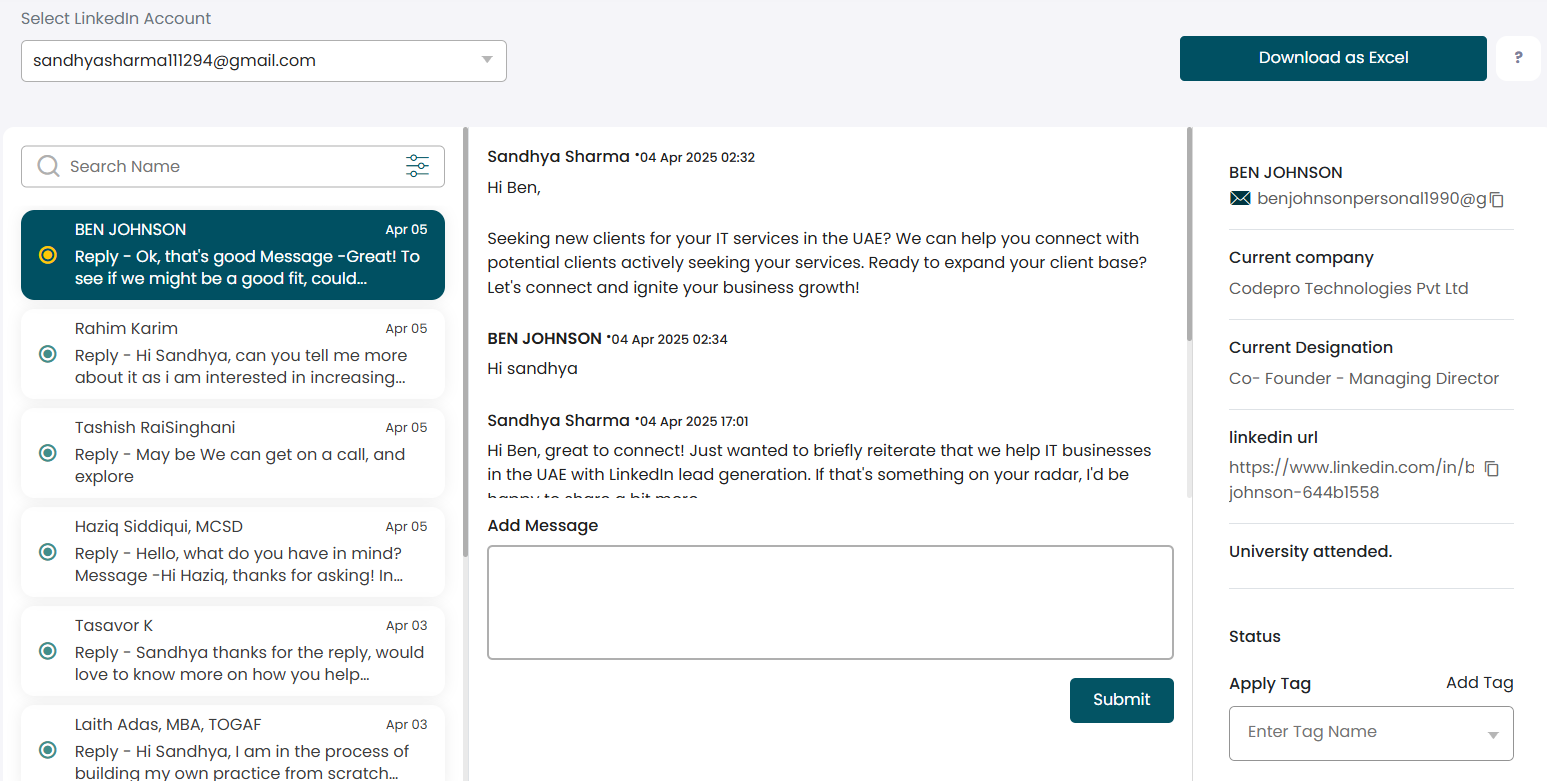

📊 Inside the LinkedoJet Dashboard

LinkedoJet is more than a LinkedIn automation tool — it’s a full-stack outreach system for fundraising platforms. We blend consulting-first strategy with a powerful dashboard so you can generate, track, and scale qualified LinkedIn leads from founders and investors.

- Custom ICP Setup: Define founder and investor audiences with precision.

- Message Strategy: Narrative-led outreach built for fundraising conversations, not spam.

- Transparent Lead Tracking: Every reply, intro, and call is logged in your dashboard.

- Consulting-Backed Delivery: A system powered by outreach strategists, not just software.