🚀 Win High-Value Tax Clients with LinkedIn Outreach & Automation

Done-for-you LinkedIn Outreach system built for tax advisory firms, CPA practices, and accounting consultants. Generate qualified LinkedIn leads, book consultations with CFOs and finance leaders, and scale client acquisition with AI-powered personalization. Free Custom Report (worth $100) included.

Claim Free Report Book a Free Strategy Call✅ Who Is This Outreach Strategy Built For?

- Tax Advisory & CPA Firm Partners: Win corporate tax, VAT, and international tax mandates without relying only on referrals.

- Business Development Leaders in Tax Firms: Start qualified conversations with CFOs, Finance Directors, and Founders through LinkedIn lead generation.

- Accounting & Tax Consultants Expanding Verticals: Target industries like SaaS, real estate, logistics, or healthcare and validate offers quickly with LinkedIn outreach.

- Independent Tax Professionals: Position yourself as a trusted advisor and book steady consultations with dream clients.

🎯 What Makes LinkedoJet Different from Other Outreach Tools for Tax Advisors?

- No spam — every LinkedIn message is tailored using AI insights from prospect roles, industries, and company financials.

- Created specifically for tax advisors, accountants, and consultants selling expertise-driven, high-value services.

- We combine ICP building, offer positioning, and campaign iteration — not just automation, but a full client acquisition system.

- Focus on relationship-building — personalized conversations that convert into discovery calls and long-term clients.

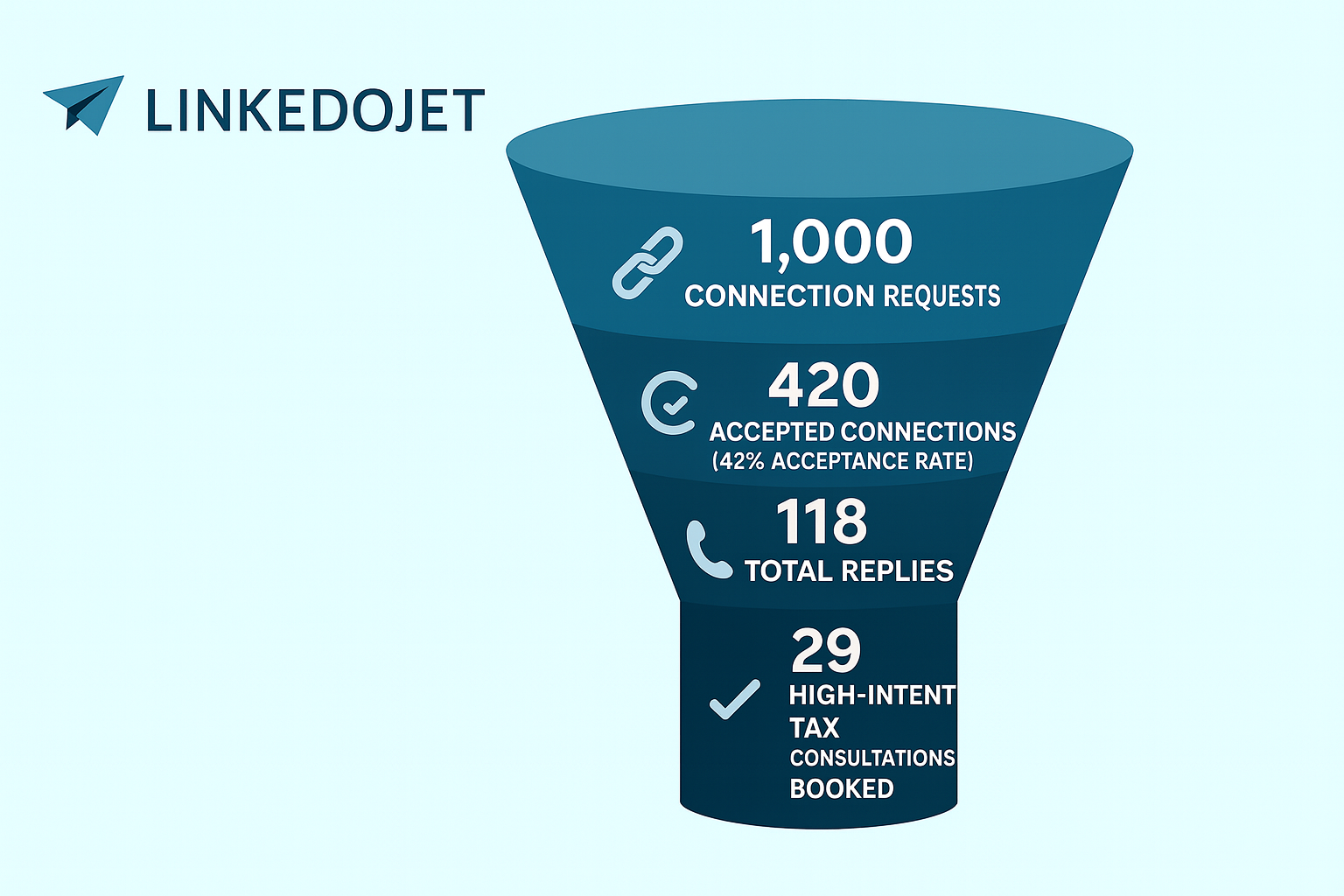

📈 Early Campaign Results

- 🔗 1,000 Connection Requests Sent

- ✅ 420 Accepted Connections (42% acceptance rate)

- 💬 118 Total Replies (11.8% reply rate)

- 📞 29 High-Intent Tax Consultations Booked

- 🧳 Most Interest Shown In: Corporate Tax Planning, International Tax Structuring, VAT/GST Compliance, Transfer Pricing

- 🌎 Top Responding Regions: USA, UK, UAE, India, Singapore

Why Deeply Personalized LinkedIn Outreach Works for Tax Advisory

- Direct access to decision‑makers: Reach CFOs, Finance Directors, Controllers, and Founders — no forms, no gatekeepers.

- Conversations > Cold Pitches: Value‑led outreach sparks interest, builds trust, and opens doors without sounding “salesy.”

- Fast feedback loops: Learn quickly if your tax offer (e.g., transfer pricing, VAT/GST, international structuring) resonates — then refine.

- Turn prospects into promoters: A credible first impression turns into referrals, testimonials, and long‑term retainers.

AI‑Powered Personalization — Beyond Templates

Modern LinkedIn Automation for tax advisors goes beyond templates. It crafts messages aligned to each buyer’s finance calendar and risk priorities, using AI to power intelligent LinkedIn Outreach.

With OpenAI & Gemini, LinkedoJet analyzes roles, posts, and company signals to deliver truly 1:1 outreach that resonates and converts.

- Title‑Specific Messaging: Speak differently to a CFO vs. a Head of Tax — AI understands that nuance.

- Activity‑Based Triggers: Reference recent posts (e.g., year‑end close, audit readiness, VAT filings) for hyper‑contextual intros.

- Company Intelligence: Personalize by region (VAT/GST rules), entity footprint (permanent establishment risk), hiring, or expansion news.

- Natural Language Tuning: Messages don’t “feel” AI‑generated — they feel like someone took time to understand their tax context.

📌 Tax Advisory Example: TaxNova Partners — Corporate & International Tax

🏢 Company Overview

Name: TaxNova Partners

Category: Corporate Tax, International Tax, Transfer Pricing, VAT/GST (fictional)

HQ: Dubai, UAE · Offices: London & Mumbai

What it does: Helps mid‑market and growth companies optimize tax structures, manage cross‑border risk, and stay VAT/GST compliant.

🎯 Ideal Customer Profile (ICP)

Persona: CFO / Finance Director / Head of Tax

Target Companies: 100–1,500 employees in SaaS, Logistics, Manufacturing, E‑commerce, Hospitality, Real Estate

Regions: UAE, UK, EU, USA, India, Singapore (multi‑entity / cross‑border)

Main Challenges: Year‑end tax exposure, transfer pricing documentation, VAT/GST errors, PE risk, R&D credits.

📬 Value‑Driven Outreach Sequence (Soft CTA Style)

“Most tax exposure isn’t from big restructures — it’s from small, recurring process gaps (VAT filings, intercompany charges, TP policies) that pile up.”

Just starting a conversation — no pitch.

“In mid‑market groups, misclassified cross‑border services are a top driver of VAT penalties.”

Offers a 1‑page “VAT risk quick scan” — no pressure.

“Finance teams don’t need more theory — they need a checklist that the auditors won’t contest.”

A human, operations‑first POV — still no pitch.

Reduced assessed exposure by 37% for a GCC‑EU group by aligning intercompany charges and updating TP policies pre‑audit.

“Year‑End Tax Risk Scan — 7 checks most mid‑market groups miss” (2‑min checklist, no strings attached).

📌 Outreach Example: TaxNova — CFO‑First LinkedIn Flow

🎯 Ideal Customer Profile (ICP)

Name: Dana Kapoor

Role: CFO / Finance Director

Company: Multi‑entity logistics group (~300–800 employees)

Challenges: VAT errors across jurisdictions, undocumented intercompany services, audit readiness, TP file gaps.

💬 Message 1: Curiosity‑Driven Connection

“The biggest year‑end surprises often come from small VAT and intercompany gaps that compound quietly.”

📊 Message 2: Value Drop via Stat

“Mid‑market groups frequently overpay due to misapplied VAT on cross‑border services and weak invoice narratives.”

🧠 Message 3: Emotional Resonance

“Finance teams don’t want theory at year‑end — they want a clean pack auditors can’t poke holes in.”

📚 Message 4: Transformation Story

Cut assessed exposure 37% for a GCC‑EU group by aligning intercompany charges + TP policies before audit.

✅ Message 5: Free Checklist + Soft CTA

“Year‑End Tax Risk Scan (2‑min)” — happy to share the 7 checks most teams miss.

This sequence follows the LinkedoJet principle — lead with curiosity, earn trust with insight, and offer a CTA only when timing feels natural. Each message compounds credibility and relevance.

🧾 Full Message Set

Hi Dana,

Thanks for connecting.

A theme I keep hearing from mid‑market finance leaders:

“The biggest tax surprises don’t come from big restructures — they come from small VAT and intercompany gaps that add up.”

Have you seen this across your entities? Curious how you’re handling cross‑border services and invoice narratives.

No pitch — just comparing notes.

Warm regards,

[Your Name]

Hi Dana,

Quick insight we’ve seen repeatedly:

🧠 Cross‑border services with weak narratives drive a large share of VAT assessments in multi‑entity groups.

One logistics client reduced exposure by 37% after we aligned intercompany charges and refreshed TP policies — before audit.

If useful, happy to share a 1‑page “Year‑End Tax Risk Scan” (2‑min, practical checklist). No pressure.

Best,

[Your Name]

🎯 Key Benefits of Personalized Outreach for Tax Advisors

🚀 Win Corporate & HNWI Tax Clients

Reach CFOs, Finance Directors, and Founders directly through LinkedIn Lead Generation — the people who actually say “yes” to tax advisory, compliance, or structuring mandates.

💬 Start Conversations That Lead to Engagements

Skip generic cold emails. Our LinkedIn Outreach builds rapport around urgent financial needs — such as tax optimization, VAT/GST compliance, transfer pricing, and international expansion.

📈 Validate Your Tax Advisory Offers Quickly

Don’t waste months on conferences or ads. Use LinkedIn Automation to test positioning, refine your pitch, and see what finance leaders and decision-makers respond to in real time.

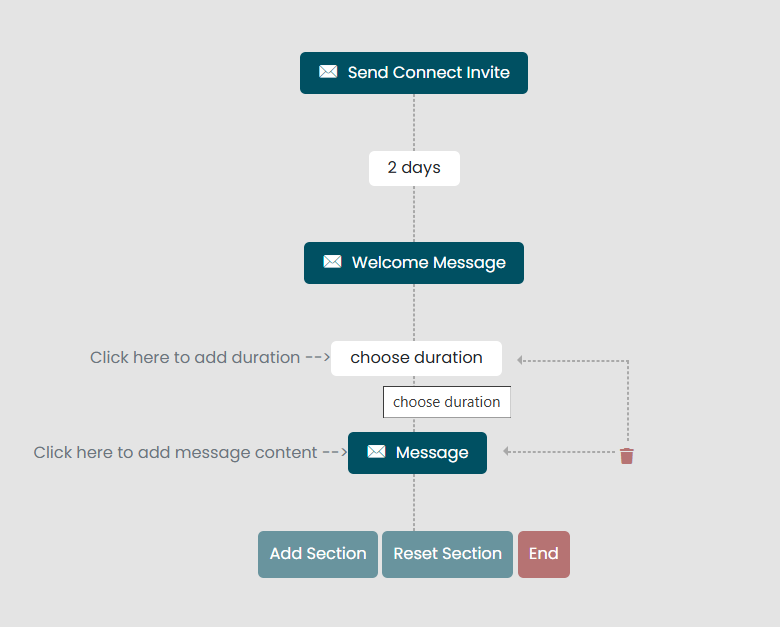

🔁 The Outreach Flow — From Connection to Consultation

❓ Frequently Asked Questions

Do I need a big marketing budget?

No. You don’t need ads, events, or costly sponsorships. Our LinkedIn Lead Generation for tax firms is lean, precise, and designed to deliver qualified clients without heavy ad spend.

How soon can I expect results?

Most tax advisors start seeing warm replies and booked consultations with CFOs or Founders within 7–10 days of campaign launch.

Is this just another cold email script?

Not at all. Every LinkedIn message is AI-personalized using the prospect’s role, company profile, and activity — no copy-paste spam or generic outreach.

What types of tax advisors benefit most?

Corporate tax advisors, CPA firms, VAT/GST consultants, international tax structuring experts, and R&D tax credit specialists seeking high-value mandates.

What if I’m not sure who my ideal client is yet?

That’s actually the best time to start. LinkedoJet helps you test multiple ICPs fast — so you know whether CFOs, SMEs, or multinationals respond best to your tax services.

How is LinkedoJet different from tools like Dripify or PhantomBuster?

LinkedoJet isn’t just a LinkedIn automation tool — it’s a complete outreach system. You get ICP targeting, custom tax-specific messaging, AI personalization, and transparent dashboard tracking.

📚 How to Use Your Free LinkedIn Outreach Report

- Review the tailored ICP segmentation (roles, industries, regions)

- Apply filters in LinkedIn Sales Navigator

- Use the 4-message outreach sequence inside the report to start conversations

- Track replies, adjust, and refine — feedback = fuel

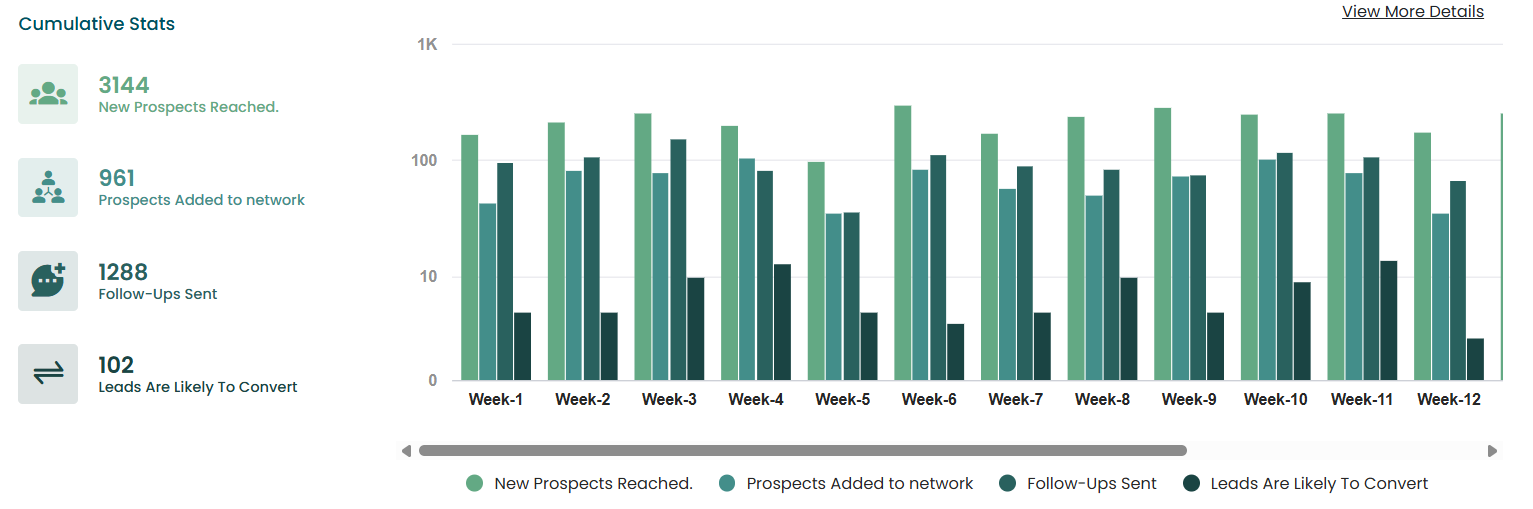

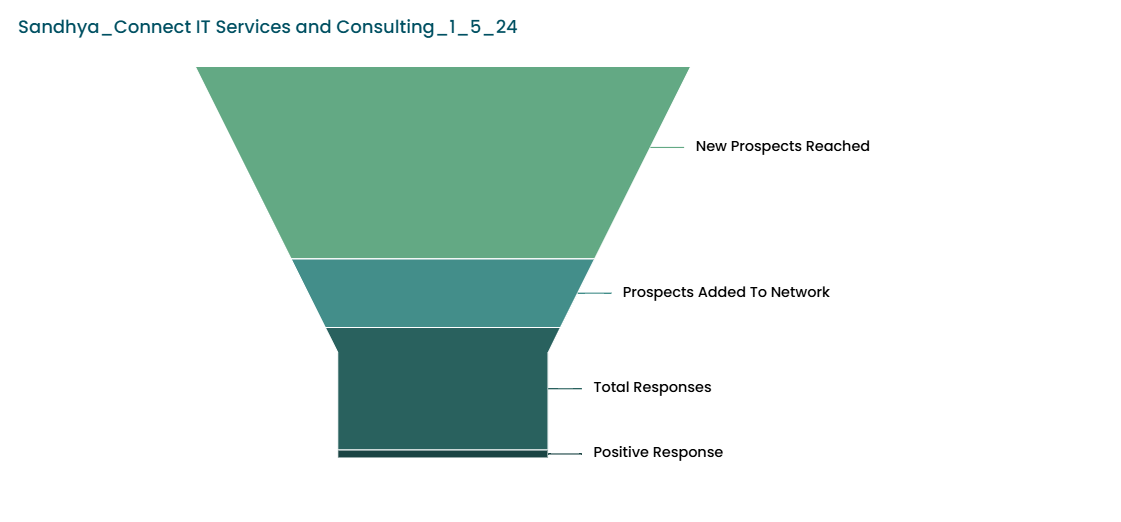

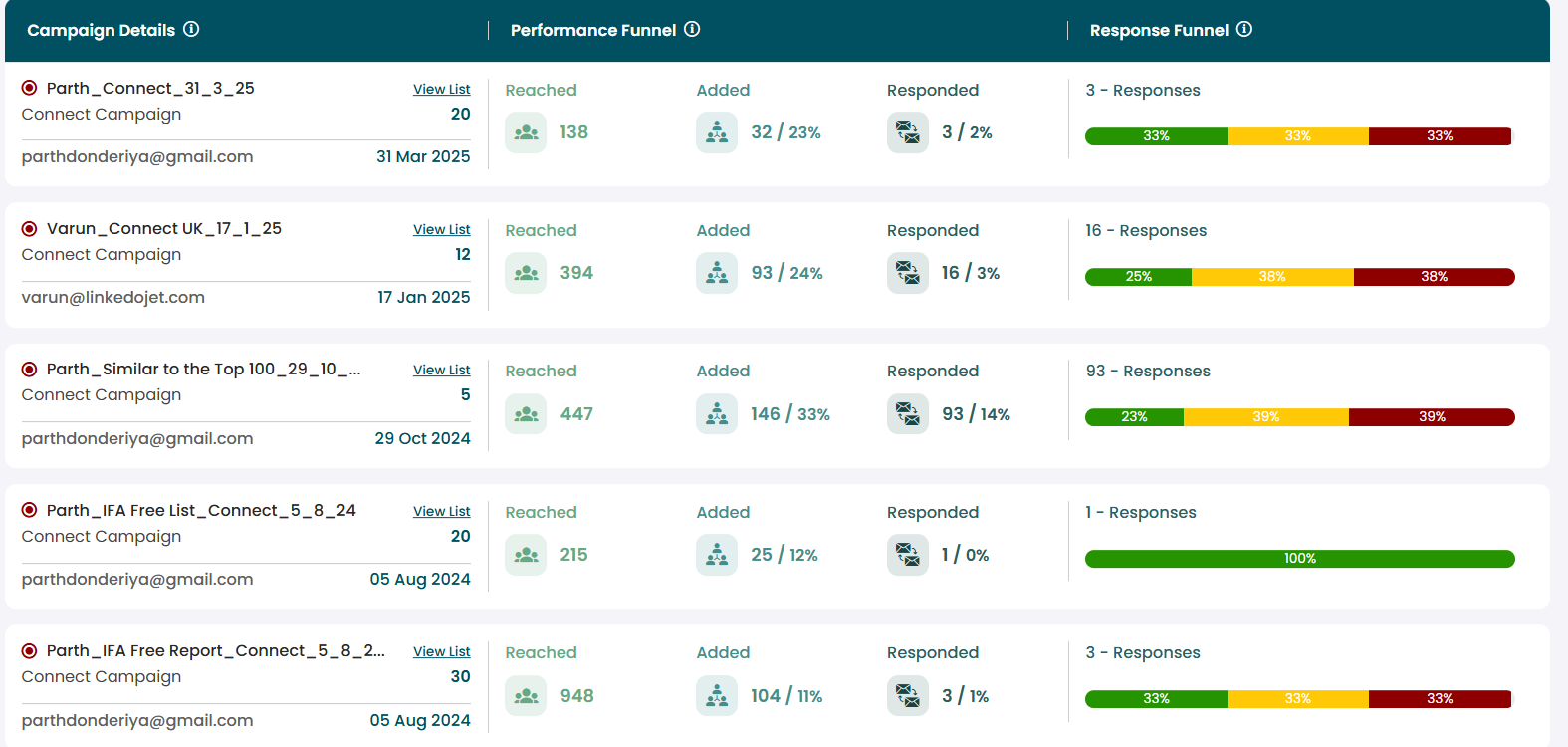

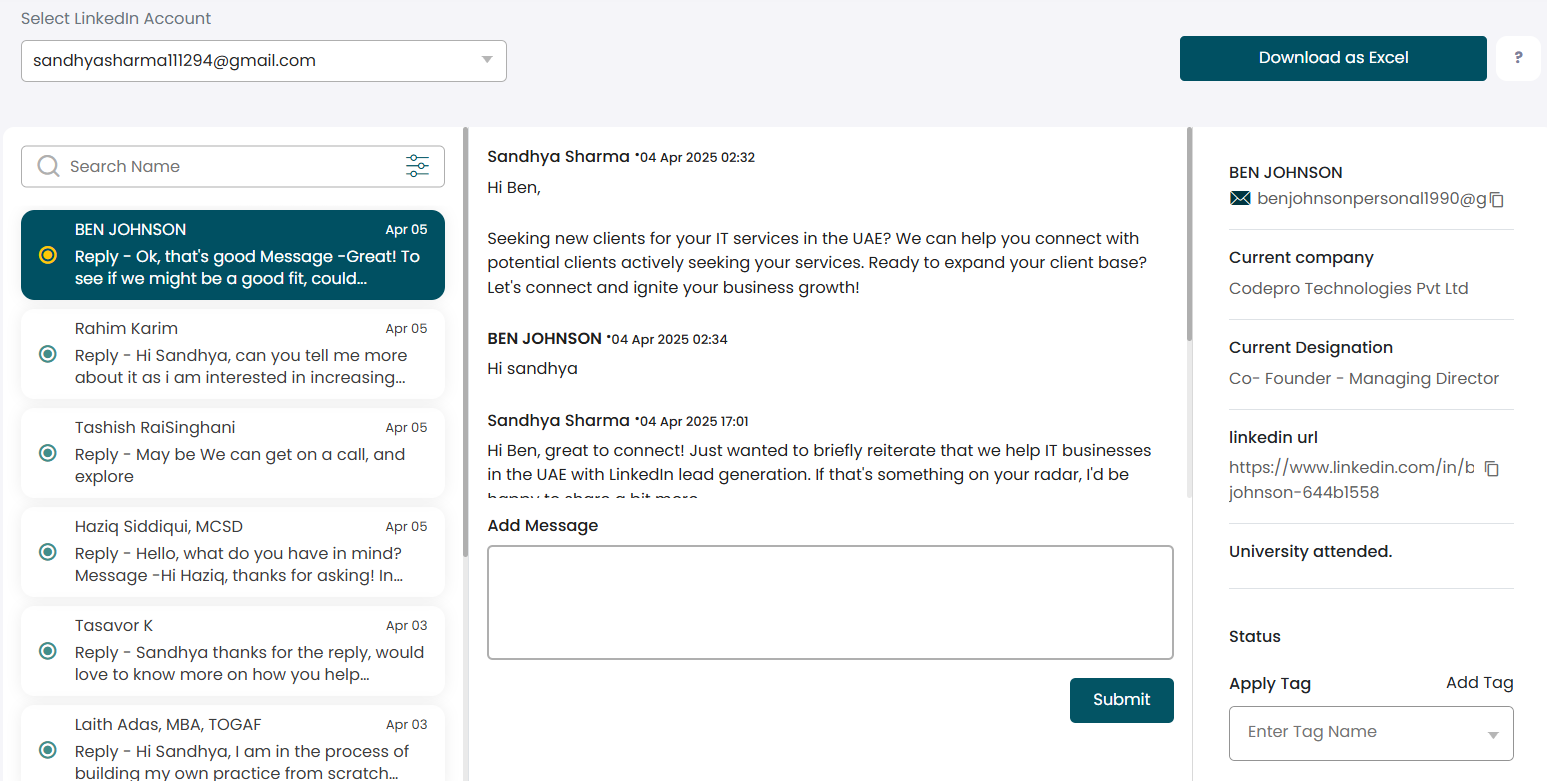

📊 Inside the LinkedoJet Dashboard

LinkedoJet is more than LinkedIn automation — it’s a full outreach system for tax advisors. We combine a consulting-first approach with a powerful dashboard so you can generate and track qualified LinkedIn Leads at every step.

- Custom ICP Setup: Define CFOs, Finance Directors, or Founders as your Ideal Client Profile.

- Message Strategy: Campaigns are designed around tax compliance, cross-border structuring, and ROI-driven value propositions.

- Transparent Lead Tracking: Every reply, meeting, and conversion is visible inside your dashboard.

- Consulting-Backed Delivery: Get not just automation, but outreach strategy tailored to tax advisory mandates.