🚀 Generate Proprietary Deal Flow with LinkedIn Outreach for M&A Advisors

Done-for-you LinkedIn Outreach system designed for M&A advisors, investment bankers, and corporate development teams. Use LinkedIn lead generation and AI-powered LinkedIn automation to connect with business owners, private equity, and investors — building a high-quality pipeline of opportunities. Free Custom Report (worth $100) included.

Claim Free Report Book a Free Strategy Call✅ Who Is This Outreach Strategy Built For?

- M&A Advisors & Investment Bankers: Win new mandates by sourcing business owners exploring exits and investors searching for opportunities on LinkedIn.

- Corporate Development Leaders: Start more conversations with founders, CFOs, and CEOs about acquisitions and strategic partnerships.

- Private Equity & Family Offices: Run AI-powered LinkedIn outreach campaigns to surface proprietary mid-market deal flow globally.

- Boutique Firms & Consultants: Position yourself as a trusted deal partner and consistently secure qualified discovery calls.

🎯 What Makes LinkedoJet Different from Other Outreach Tools for M&A?

- No spam — every LinkedIn message is AI-personalized using insights from the owner’s role, company, and industry.

- Created specifically for dealmakers — M&A advisors, investment bankers, and corporate development executives.

- Combines ICP building, deal sourcing filters, and campaign feedback loops — not just automation, but a full outreach system.

- Relationship-first — conversations that build trust and convert into mandates, buy-side opportunities, and sell-side engagements.

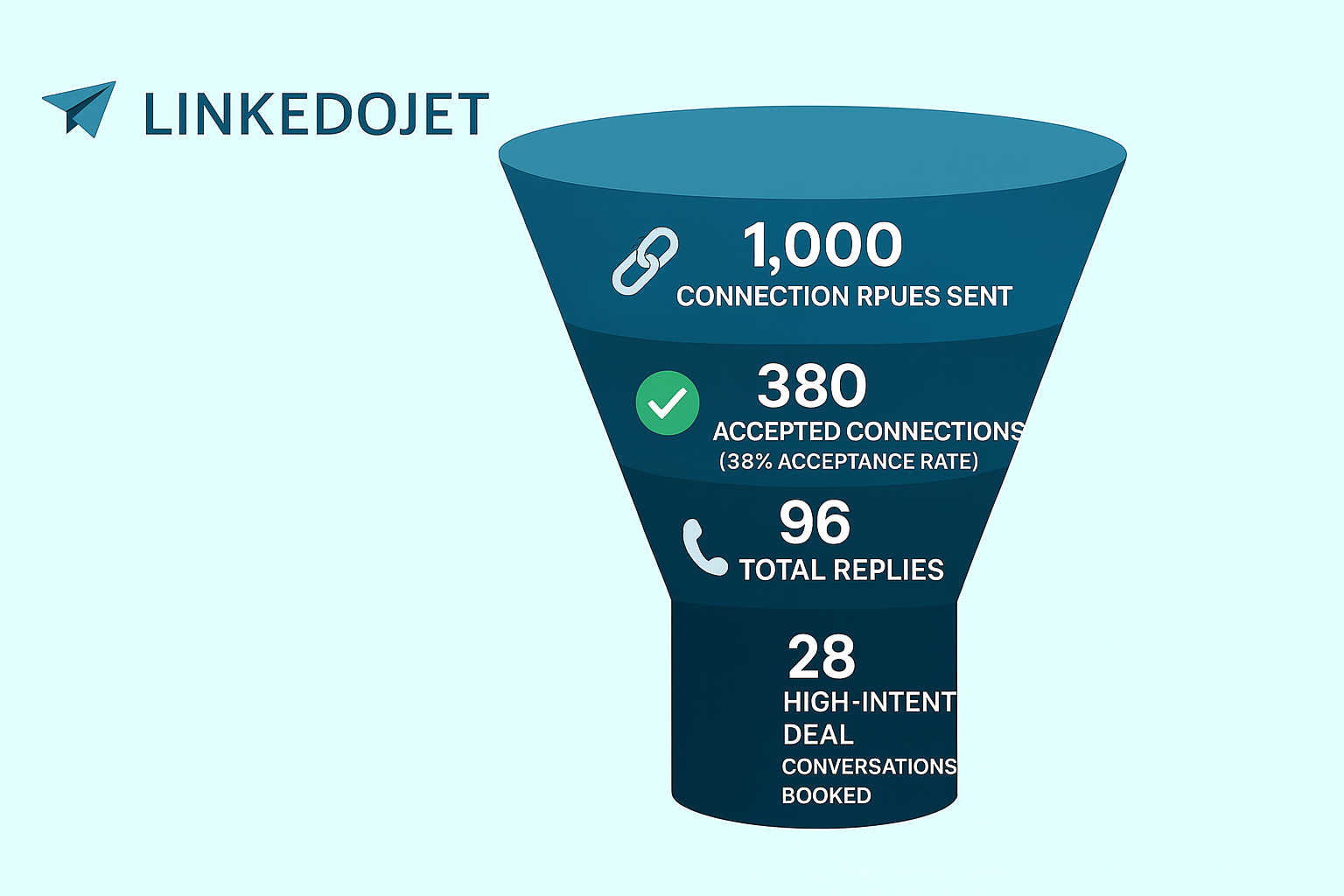

📈 Early Campaign Results

- 🔗 1,000 Connection Requests Sent

- ✅ 380 Accepted Connections (38% acceptance rate)

- 💬 96 Total Replies (9.6% reply rate)

- 📞 28 High-Intent Deal Conversations Booked

- 🏭 Most Interest Shown In: Manufacturing, IT Services, Healthcare, Logistics

- 🌎 Top Responding Regions: USA, UK, UAE, India, Europe

Why Deeply Personalized LinkedIn Outreach Works

- Direct access to decision-makers: Reach business owners, CFOs, and investors directly on LinkedIn — no gatekeepers, no intermediaries.

- Conversations > Cold Pitches: Smart LinkedIn outreach builds trust and opens deal discussions without coming across as “salesy.”

- Fast feedback loops: Know quickly if owners are open to exit talks or investors are seeking opportunities — and adapt messaging instantly.

- Turn connections into mandates: A single quality LinkedIn conversation can lead to buy-side, sell-side, or capital-raising engagements.

AI-Powered Personalization — Beyond Templates

Modern LinkedIn automation for M&A advisors goes beyond sending generic templates. It creates highly contextual outreach that aligns with each stakeholder’s journey — whether they’re a business owner, investor, or corporate development executive.

With OpenAI & Gemini, LinkedoJet analyzes job roles, posts, and company activity to deliver truly 1:1 LinkedIn messages that resonate and convert.

- Role-Specific Messaging: Speak differently to a business owner vs. a private equity principal — AI understands those nuances.

- Activity-Based Triggers: Reference what they’ve shared, posted, or engaged with on LinkedIn for hyper-relevant intros.

- Company Intelligence: Personalize based on size, industry, funding stage, or recent acquisitions.

- Natural Language Tuning: Messages don’t “feel” automated — they feel like tailored outreach from a trusted advisor.

📌 Case Example: CapitalEdge Partners – Mid-Market M&A Advisory

🏢 Company Overview

Name: CapitalEdge Partners

Category: M&A Advisory Boutique

Founded: 2018

HQ: London, UK

Website: capitaledgeadvisors.com (fictional)

What it does: Advises mid-market businesses on exits, acquisitions, and capital raising across manufacturing, IT, and healthcare sectors.

🎯 Ideal Customer Profile (ICP)

Persona: Raj Malhotra – Founder/Owner, mid-market company

Target Companies: $5M–$100M revenue firms in IT services, healthcare, logistics, and manufacturing

Regions: North America, UK, UAE, and India

Main Challenge: Succession planning, exit readiness, or growth capital requirements

📬 Value-Driven Outreach Sequence (Soft CTA Style)

“Many mid-market owners tell us succession planning is on their mind, but they’re unsure when to start. Curious if that’s relevant for you?”

No pitch — just opening the conversation.

“Mid-market M&A activity rose 14% last year in IT & healthcare sectors — valuations are holding strong despite market volatility.”

Shares a 2-page market trends sheet.

“For many owners, it’s not just about valuation — it’s about protecting legacy and ensuring a smooth transition.”

A reflective observation, not a pitch.

“Helped a 200-employee IT services firm secure a strategic exit in 9 months — balancing valuation and founder legacy.”

“Is your business exit-ready?” — A 2-min M&A readiness checklist offered with no strings attached.

📌 Outreach Example: CapitalEdge Partners – Investor & Owner Outreach Flow

🎯 Ideal Customer Profile (ICP)

Name: Samantha Lewis

Role: Business Owner (sell-side) / Investor (buy-side)

Company: Mid-market IT services firm (~150 employees)

Challenges: Exploring exit timing, attracting investors, and securing strategic fit

💬 Message 1: Curiosity-Driven Connection

“Many owners are thinking about exits in 2025. Curious if that’s something you’re considering for your business?”

📊 Message 2: Value Drop via Stat

“Mid-market deal volumes rose 14% last year in your sector despite uncertainty.”

🧠 Message 3: Emotional Resonance

“Owners often tell us — it’s about finding the right buyer, not just the highest price.”

📚 Message 4: Transformation Story

“Advised a healthcare firm through a clean exit that preserved legacy while securing 3x EBITDA multiple.”

✅ Message 5: Free Checklist + Soft CTA

“Is Your Business Exit-Ready?” — Free 2-min M&A readiness checklist shared.

This sequence follows the LinkedoJet principle: spark curiosity, build trust with insight, and only offer a CTA when the timing feels right. Each message balances data, empathy, and strategic value.

🧾 Full Message Set

Hi Samantha,

Thanks for connecting.

I’ve been speaking with a few business owners lately, and one theme keeps coming up:

“Exit planning often gets delayed until it’s urgent — but valuations are best when planned early.”

Is this something you’ve thought about for your company?

No pitch — just genuinely curious.

Warm regards,

[Your Name]

Hi Samantha,

Quick stat that stood out to me:

🧠 Mid-market deal volumes rose 14% in 2024 across IT and healthcare sectors.

One owner we advised secured a strategic exit in under a year by preparing early.

If useful, happy to share a 2-min exit readiness checklist we’ve built. No pressure.

Best,

[Your Name]

🎯 Key Benefits of Personalized LinkedIn Outreach for M&A Advisors

🚀 Source Proprietary Deals, Not Just Leads

Connect directly with business owners, CFOs, and investors on LinkedIn — the people who actually decide on exits, acquisitions, or growth capital partnerships.

💬 Start Conversations That Lead to Mandates

Avoid spray-and-pray outreach. Our messaging builds rapport around real deal triggers — like succession planning, valuation timing, or capital raise needs.

📈 Validate Interest Before Formal Engagement

Instead of waiting months for inbound leads, test your deal thesis on LinkedIn. See in real-time how owners and investors respond to your positioning.

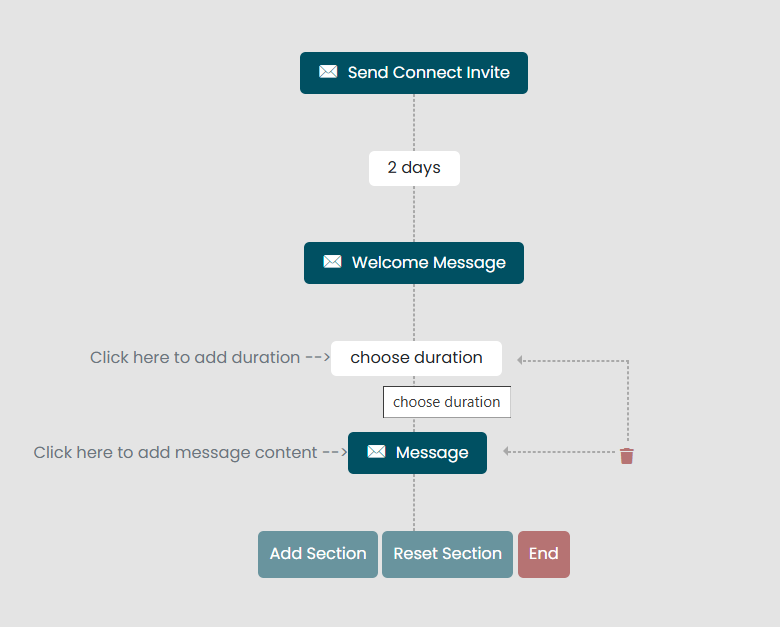

🔁 The Outreach Flow — From Connection to Closed Deal

❓ Frequently Asked Questions

Do I need a big budget?

No. You don’t need ads, conferences, or large SDR teams. Our outreach strategy is lean, AI-personalized, and designed to generate proprietary M&A conversations cost-effectively.

How soon can I expect results?

Most M&A advisors see warm replies, discovery calls, and initial deal discussions within 10–14 days of campaign launch.

Is this just another cold message template?

Not at all. Each LinkedIn message is AI-personalized based on the prospect’s role (owner, CFO, investor), industry, and recent LinkedIn activity — no copy-paste scripts.

Does this work for both buy-side and sell-side mandates?

Yes. LinkedoJet helps you identify business owners exploring exits as well as investors and private equity firms looking for acquisitions.

What if I’m not sure about my ideal client profile (ICP)?

That’s where we come in. LinkedoJet helps test multiple ICPs quickly — with real-time LinkedIn feedback from business owners, investors, and dealmakers.

How is LinkedoJet different from tools like PhantomBuster or Dripify?

Those are just automation tools. LinkedoJet is a full system: ICP strategy, custom LinkedIn messaging, AI personalization, and expert campaign support — all visible in a live deal pipeline dashboard.

📚 How to Use Your Free LinkedIn Outreach Report

- Review your tailored ICP segmentation (business owners, investors, sectors)

- Apply filters in LinkedIn Sales Navigator

- Use the included 4-message outreach flow to spark deal conversations

- Track replies, adjust positioning, and refine — market feedback = deal flow

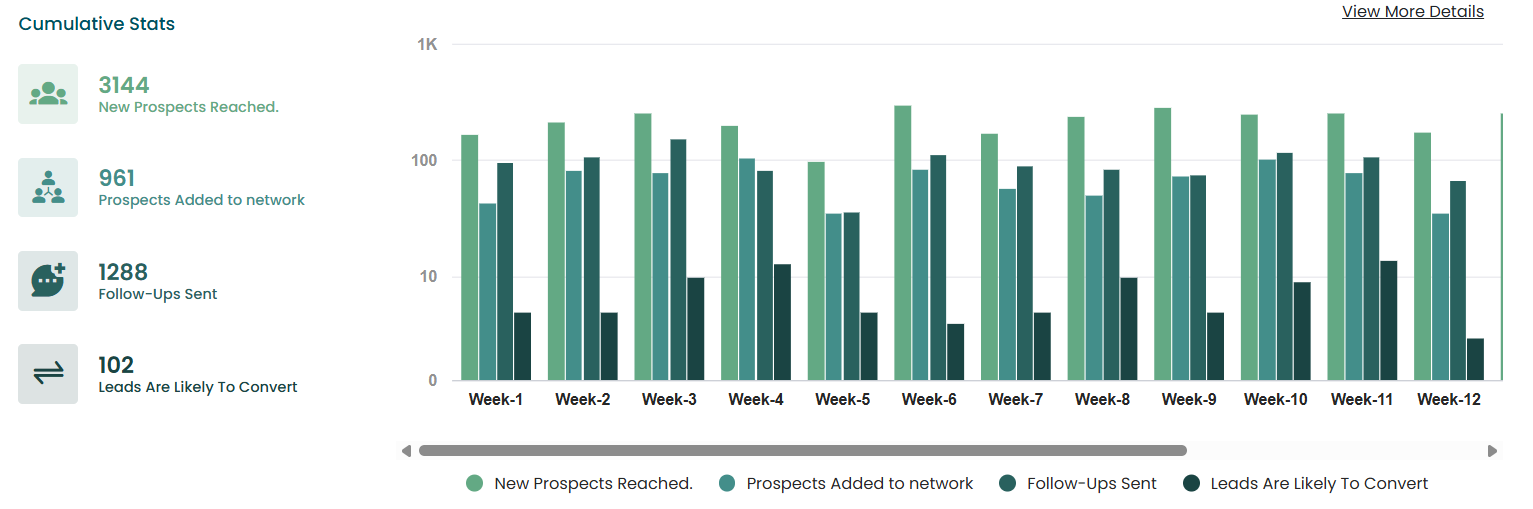

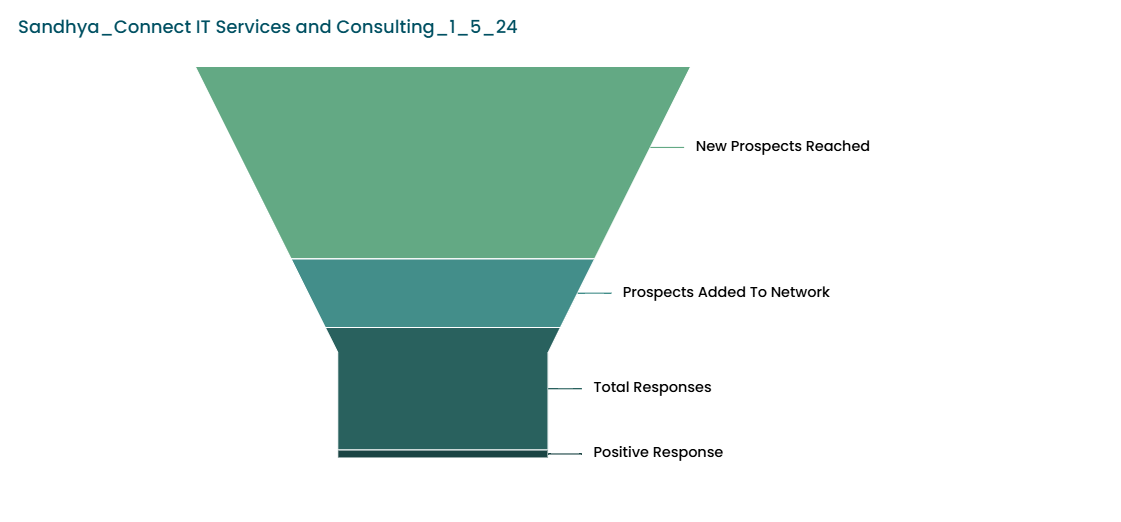

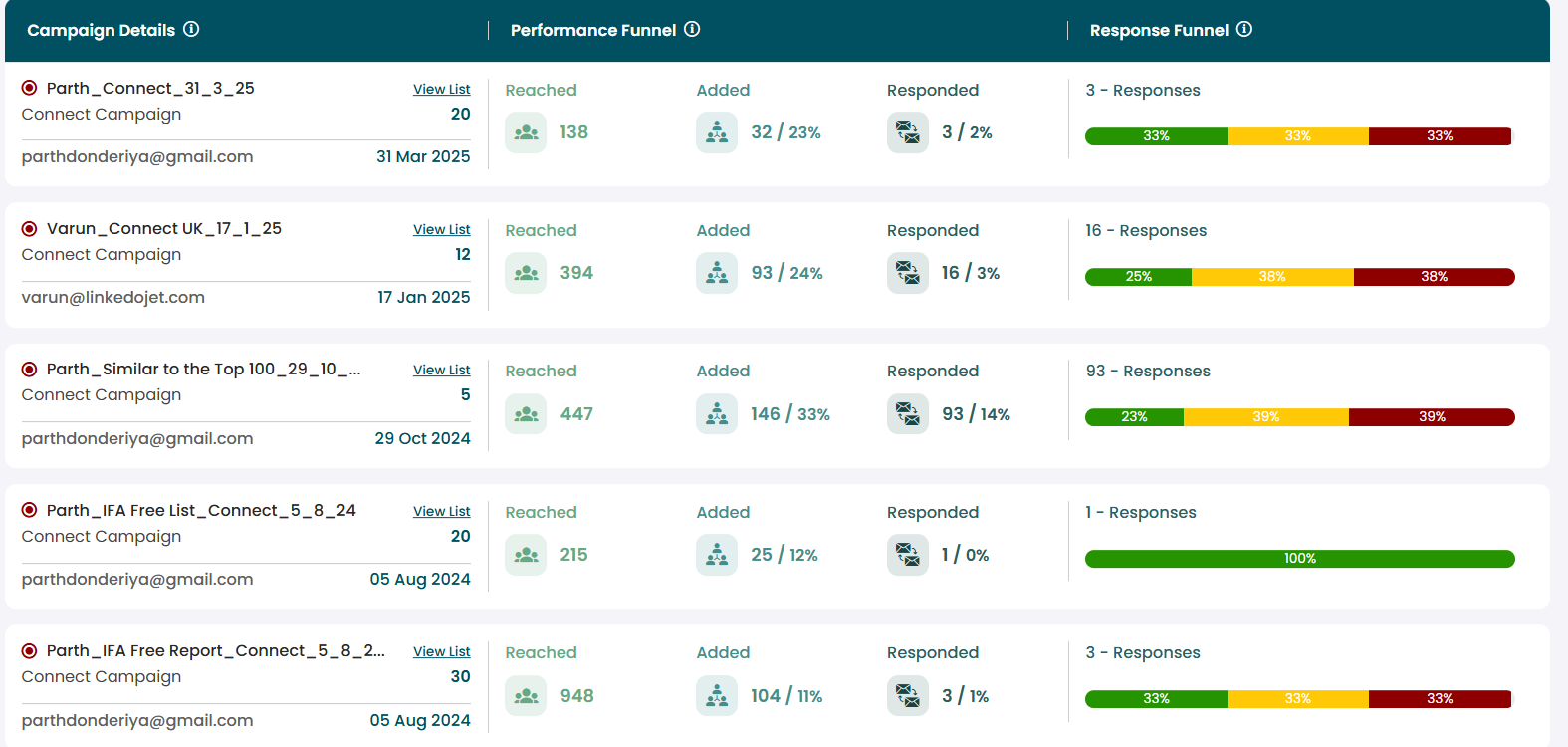

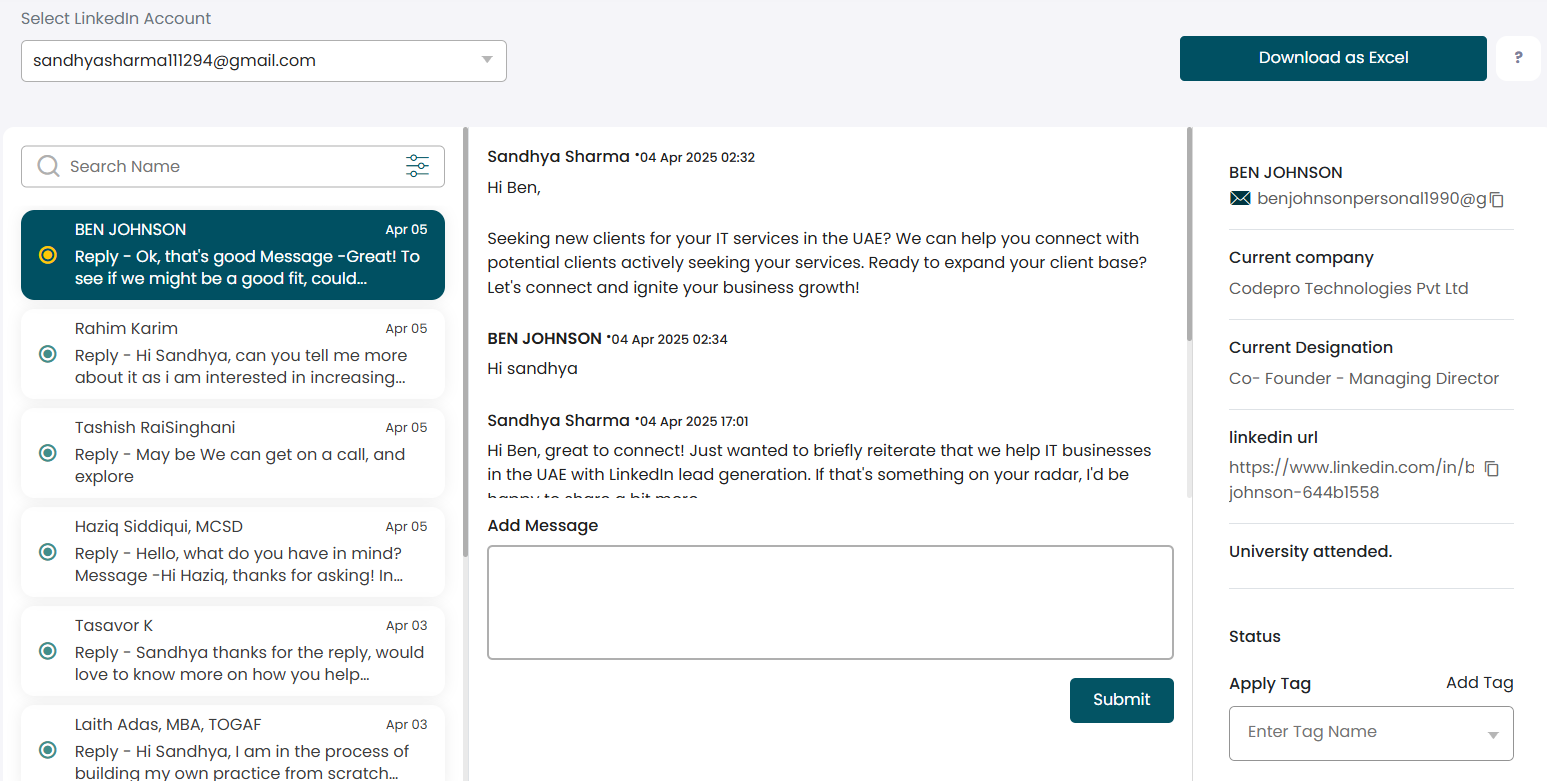

📊 Inside the LinkedoJet Dashboard

LinkedoJet is more than LinkedIn automation — it’s a full-stack M&A outreach system. We combine a consulting-first approach with a powerful dashboard to help you generate, track, and close deal opportunities at every stage.

- Custom ICP Setup: Define your Ideal Deal Profile (owners, investors, sectors) based on real LinkedIn data.

- Message Strategy: Not just automation — story-led LinkedIn messaging designed for high-value M&A conversations.

- Transparent Pipeline Tracking: Every reply, conversion, and deal stage visible inside your dashboard.

- Consulting-Backed Delivery: A deal-sourcing system supported by experienced LinkedIn outreach strategists.