⚖️ Win High-Value Corporate, IP & M&A Clients with LinkedIn Outreach

Done-for-you LinkedIn outreach & automation for law firms. Engage General Counsels, CEOs, Corp Dev leaders, PE/VC investors, and IP heads with AI-personalized messaging. Consistent lead generation for lawyers, qualified consultations, and signed mandates. Free Custom Report (worth $100) included.

Claim Free Report Book a Free Strategy Call✅ Who Is This Outreach Strategy Built For?

- Managing Partners & Practice Heads (Corporate, IP & M&A): Fill the pipeline with qualified deal-flow and advisory mandates.

- BD/Marketing Leaders at Law Firms: Start more conversations with GCs, founders, and investors using tailored messaging.

- Boutique & Cross-Border Practices: Win international clients for JV agreements, due diligence, and transaction support.

- Solo/Partner-Led Firms: Position as premium counsel and book discovery calls consistently with ideal clients.

🎯 What Makes LinkedoJet Different for Law Firms?

- No spam — every message is AI-tailored using role, sector, and recent signals (funding, patent filings, expansions).

- Built for legal BD: corporate transactions, IP portfolios, and M&A workflows — not generic “spray & pray.”

- End-to-end system: ICP design, offer positioning, compliance-aware outreach, and feedback loops — not just software.

- Relationship-first outreach that feels human and converts into qualified consultations and mandates.

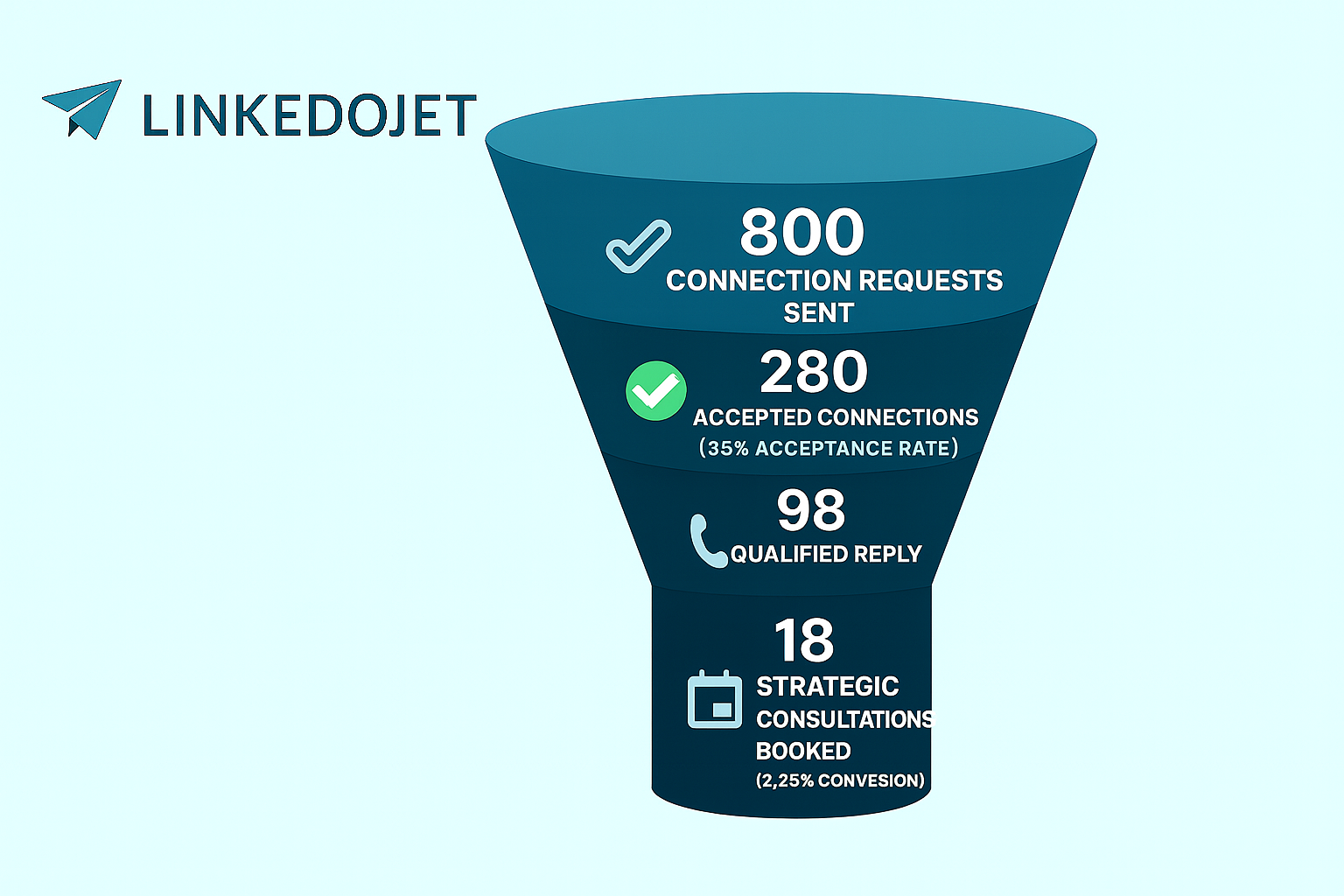

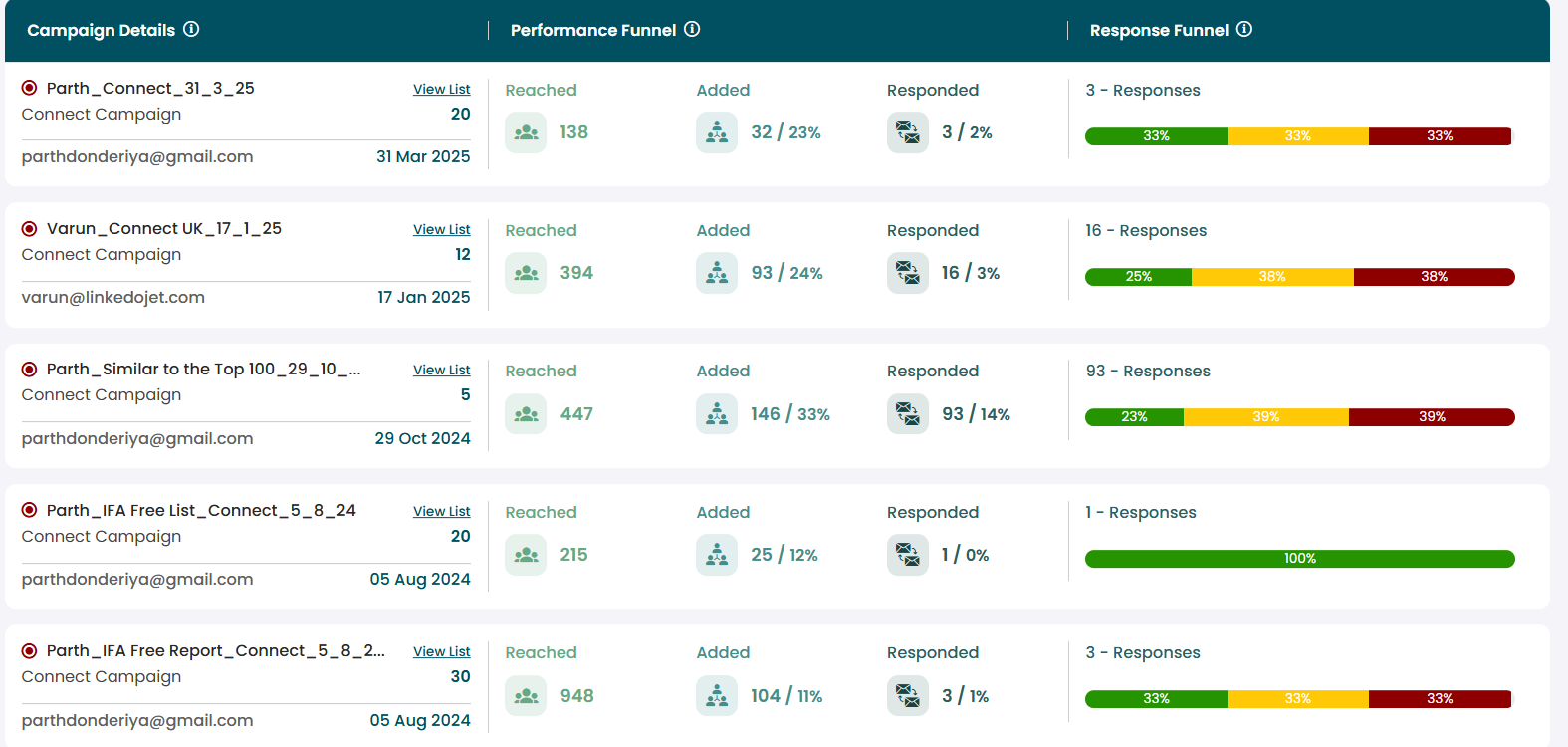

📈 Early Campaign Results

- 🔗 800 Connection Requests Sent

- ✅ 280 Accepted Connections (35% acceptance rate)

- 💬 98 Qualified Replies (35% reply rate on accepts)

- 📅 18 Strategic Consultations Booked (≈2.25% overall)

- 🧳 Most Interest Shown In: Contract reviews, IP portfolio audits, tech transactions, cross-border M&A readiness

- 🌎 Top Responding Countries: USA, UK, UAE, India, Singapore

Why Deeply Personalized LinkedIn Outreach Works for Law Firms

- Direct access to decision-makers: Speak with General Counsels, CEOs, Corp Dev leaders, IP heads, and investors — no RFP portals, no gatekeepers.

- Conversations > Cold pitches: Insight-led messages earn trust, open deal discussions, and lead to mandates without sounding “salesy.”

- Fast feedback loops: Validate interest in services like due diligence, tech transactions, or IP portfolio audits — and fine-tune positioning quickly.

- From interest to instructions: A credible first exchange turns into referrals, panel invites, and long-term client relationships.

AI-Powered Personalization — Beyond Templates

Modern LinkedIn outreach for Corporate, IP & M&A practices goes beyond templates. It aligns with the buyer’s legal needs and stage — using AI to power compliant, context-aware messaging.

With OpenAI & Gemini, LinkedoJet analyzes roles, posts, filings, and company signals to deliver truly 1:1 outreach that resonates and converts.

- Title-Specific Messaging: Speak differently to a GC vs. a CFO vs. a Head of Corp Dev — the nuance matters in legal procurement.

- Activity-Based Triggers: Reference deal announcements, patent filings, market entries, funding rounds, or hiring spikes for relevant intros.

- Company Intelligence: Personalize around growth stage, compliance posture, data-privacy footprint, and anticipated transaction timelines.

- Natural Language Tuning: Messages feel human, professional, and confidentiality-aware — never like generic AI output.

📌 Firm Example: LexBridge Partners — Corporate, IP & M&A Counsel

🏢 Firm Overview

Name: LexBridge Partners

Category: Corporate, Intellectual Property & M&A Law Firm

Founded: 2016

HQ: Dubai, UAE

Website: lexbridge.legal (fictional)

What it does: Transaction counsel, IP strategy & portfolio management, tech & data agreements, and cross-border M&A support.

🎯 Ideal Client Profile (ICP)

Persona: Anita Rao — General Counsel / Daniel Chen — Head of Corporate Development

Target Companies: VC-backed SaaS/Fintech/Healthtech, advanced manufacturing, and global e-commerce

Regions: USA, UK, UAE, India, Singapore

Main Challenge: Accelerating deals while reducing risk — IP ownership gaps, data-privacy exposure, vendor/contract sprawl, and cross-border complexity

📬 Value-Driven Outreach Sequence (Soft CTA Style)

“Great companies still lose deals when minor IP or data-privacy gaps surface during diligence.”

Just starting a conversation — no pitch.

“In fast-moving transactions, the red flags we see most are unclear IP assignment and inconsistent vendor DPAs.”

Shares a 1-page “M&A readiness” checklist — no pressure.

“Teams often outgrow early contracts — and that misalignment shows up late in diligence.”

A reflective observation, not a pitch.

Helped a growth-stage SaaS company streamline diligence by pre-clearing IP assignments and DPAs — shortened timeline to signing.

“Is your next deal diligence-ready?” — 2-minute IP & contracts hygiene checklist. No strings attached.

📌 Outreach Example: LexBridge Partners — Legal Outreach Flow

🎯 Ideal Client Profile (ICP)

Name: Samantha Lewis

Role: General Counsel / Head of Corporate Development

Company: Series B tech company (~200–400 employees)

Challenges: Tight deal timelines, scattered vendor contracts, unclear IP assignments, and evolving data-privacy obligations

💬 Message 1: Curiosity-Driven Connection

“Strong growth stories still stumble in diligence when IP ownership or DPAs aren’t airtight.”

📊 Message 2: Value Drop via Insight

“Top diligence issues we see: employee IP assignments, open-source usage, and vendor data-flows.”

🧠 Message 3: Emotional Resonance

“When contracts lag behind reality, even great teams lose deal velocity.”

📚 Message 4: Transformation Story

“Pre-cleared IP & data terms helped a client remove late-stage hurdles and keep their acquisition timeline on track.”

✅ Message 5: Free Checklist + Soft CTA

“2-minute M&A readiness checklist — happy to share if useful.”

This sequence follows the LinkedoJet principle — lead with curiosity, add practical insight, and invite next steps only when the timing is right. Each touch builds on the last.

🧾 Full Message Set

Hi Samantha,

Thanks for connecting.

I’ve been speaking with a few GCs and Corp Dev leaders lately, and one theme keeps coming up:

“Great teams still lose time in diligence when IP ownership or data-privacy terms aren’t crystal-clear.”

Have you seen this in your recent cycles? Curious how you’re approaching pre-deal IP & contracts hygiene.

No pitch — just genuinely curious.

Warm regards,

[Your Name]

Hi Samantha,

Quick observation we see across growth-stage deals:

• IP assignments (employees/contractors),

• OSS usage mapping, and

• vendor DPAs/data-flows

tend to surface late — and slow good transactions.

If helpful, happy to share a 5-point “M&A readiness” checklist we use with clients. No pressure.

Best,

[Your Name]

🎯 Key Benefits of Personalized Outreach for Corporate, IP & M&A Lawyers

⚖️ Engage Decision-Makers, Not Gatekeepers

Reach General Counsels, CEOs, Heads of Corp Dev, IP leaders, and PE/VC deal teams — the people who actually advance diligence, issue RFPs, and instruct counsel.

💬 Conversations that Open Mandates

Skip generic pitches. Insight-led messaging around IP ownership, data-privacy exposure, vendor contracts, and deal readiness builds trust and sparks qualified consultations.

📈 Validate Demand & Timing Fast

Test interest in due diligence support, IP portfolio audits, tech transactions, or cross-border M&A — refine positioning based on real responses, not assumptions. This is lead generation for lawyers that compounds.

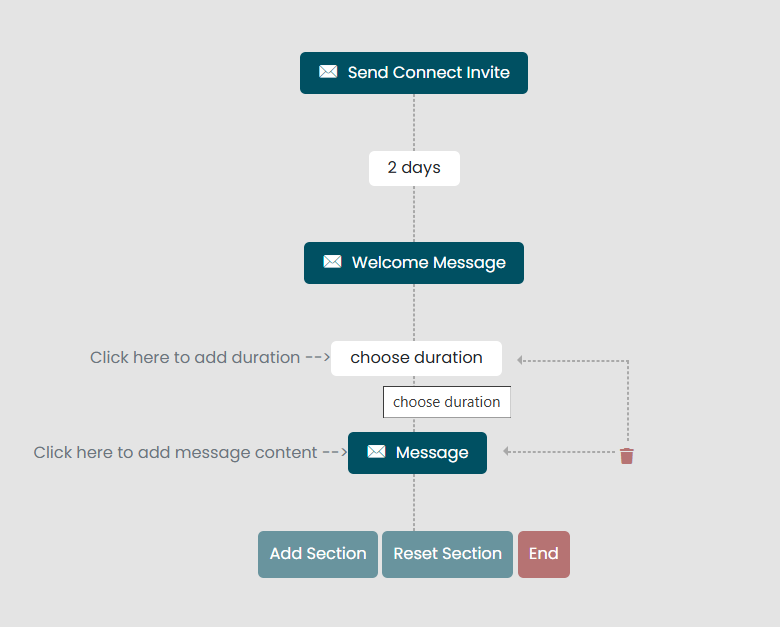

🔁 The Outreach Flow — From Stranger to Signed Engagement

❓ Frequently Asked Questions

Do I need a big budget?

No. You don’t need ads or an SDR team. We use lean, research-driven outreach to open qualified conversations with GCs, Corp Dev leaders, and founders.

How long until I see results?

Most firms see warm replies and consultation requests within 7–14 days of launch, with momentum increasing as targeting and messaging are refined.

Is this just another cold message template?

Definitely not. Messages are AI-personalized using the prospect’s role, sector, recent announcements (funding, patents, market entries), and tone — never generic scripts.

What kind of law firms does this work best for?

Boutique and partner-led practices in Corporate, IP, and M&A; mid-market firms with tech and cross-border focus; and specialist teams handling diligence or IP strategy.

What if I’m not sure who my ideal client is yet?

That’s fine. We test multiple ICPs fast (GCs vs. CFOs vs. Corp Dev; SaaS vs. fintech vs. healthtech) and double-down where response and mandate likelihood are highest.

How is LinkedoJet different from generic automation tools?

LinkedoJet isn’t just a sender — it’s a legal BD system: ICP design, matter-specific messaging, AI personalization, compliance-aware sequencing, and a live dashboard.

📚 How to Use Your Free LinkedIn Outreach Report

- Review ICP segmentation (GC, CFO, Corp Dev, IP; industries & deal triggers)

- Apply filters in LinkedIn Sales Navigator (headcount, funding, geography, keywords)

- Use the 4-message sequence in the report for compliant first touches

- Track replies, qualify matters, iterate — feedback from the market fuels positioning

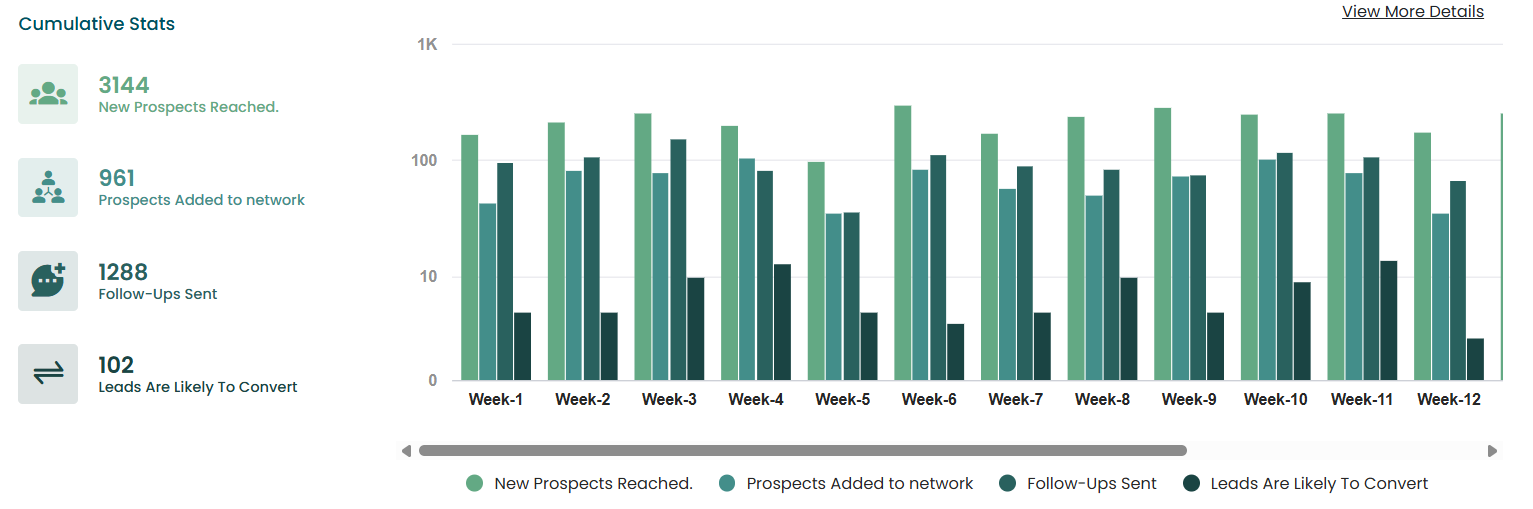

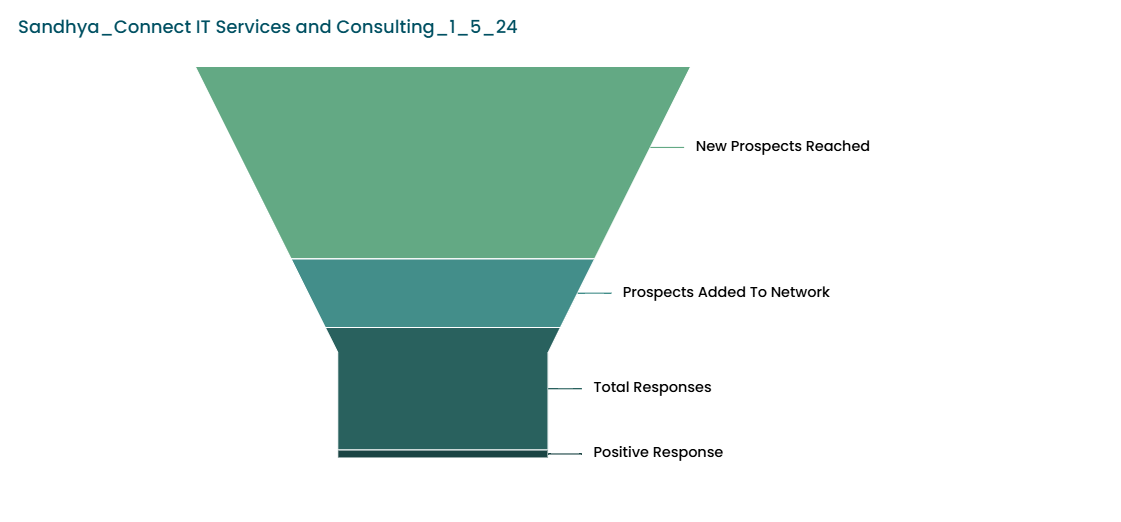

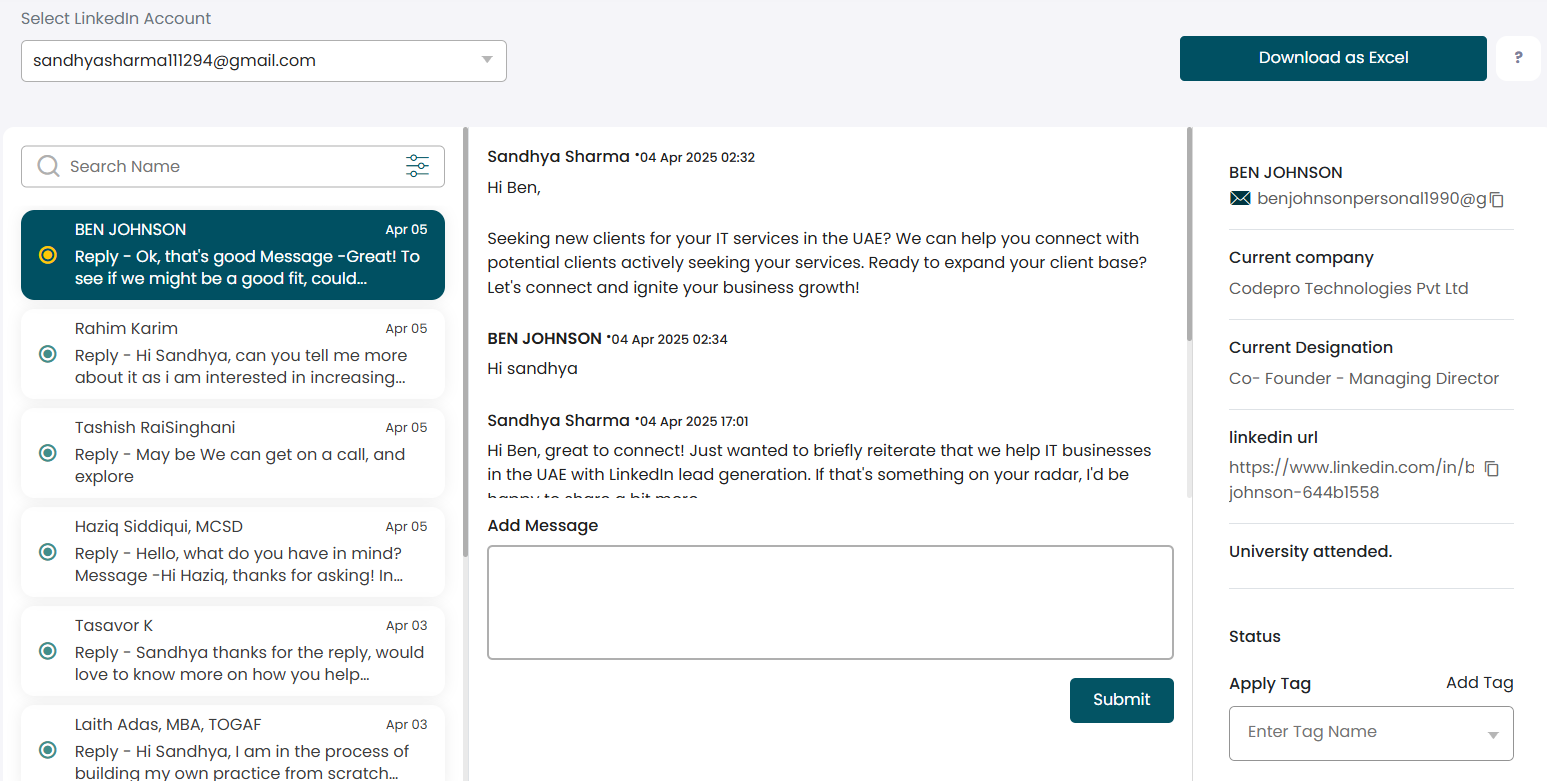

📊 Inside the LinkedoJet Dashboard

LinkedoJet is more than a “LinkedIn tool.” It’s a full-stack legal business development system that combines a consulting-first approach with a powerful dashboard to generate and track qualified opportunities end-to-end.

- Custom ICP & Matter Setup: Define personas (GC, CFO, Corp Dev, IP) and signals (funding, patents, expansions).

- Message Strategy: We don’t just automate — we craft insight-led, deal-aware messaging for each persona.

- Transparent Lead Tracking: Every reply, conversion, and stage is visible on your dashboard in real time.

- Compliance-Aware Delivery: Professional tone, opt-outs honored, and respectful cadence designed for legal audiences.