🚀 Win High-Value Clients with LinkedIn Outreach for CFO-for-Hire & Fractional CFO Services

Done-for-you LinkedIn Outreach and LinkedIn Automation system designed for CFO-for-Hire, Fractional CFOs, and Finance Consultants. Get qualified LinkedIn leads, book strategy calls with CEOs & founders, and scale client acquisition using AI-powered personalization. Free Custom Report (worth $100) included.

Claim Free Report Book a Free Strategy Call✅ Who Is This Outreach Strategy Built For?

- Fractional & Outsourced CFOs: Book recurring high-ticket clients without relying on referrals or word-of-mouth.

- Finance Consultants & CFO-for-Hire Firms: Start meaningful conversations with CEOs, founders, and investors using personalized LinkedIn outreach.

- Advisors targeting growth companies: Run campaigns to reach SaaS, ecommerce, private equity portfolio companies, and scale-ups in need of CFO expertise.

- Independent Finance Professionals: Position yourself as a premium strategic partner and land discovery calls consistently with decision-makers.

🎯 What Makes LinkedoJet Different from Other Outreach Tools for CFO Services?

- No spam — every message is tailored with AI using context from a prospect’s role, funding stage, and financial challenges.

- Built specifically for Fractional CFOs and finance consultants who sell high-trust, relationship-driven services.

- We combine ICP targeting, financial pain-point positioning, and live feedback loops — not just software, but a full client acquisition system.

- Focus on credibility and trust — outreach that feels human, builds authority, and converts into CFO consultations.

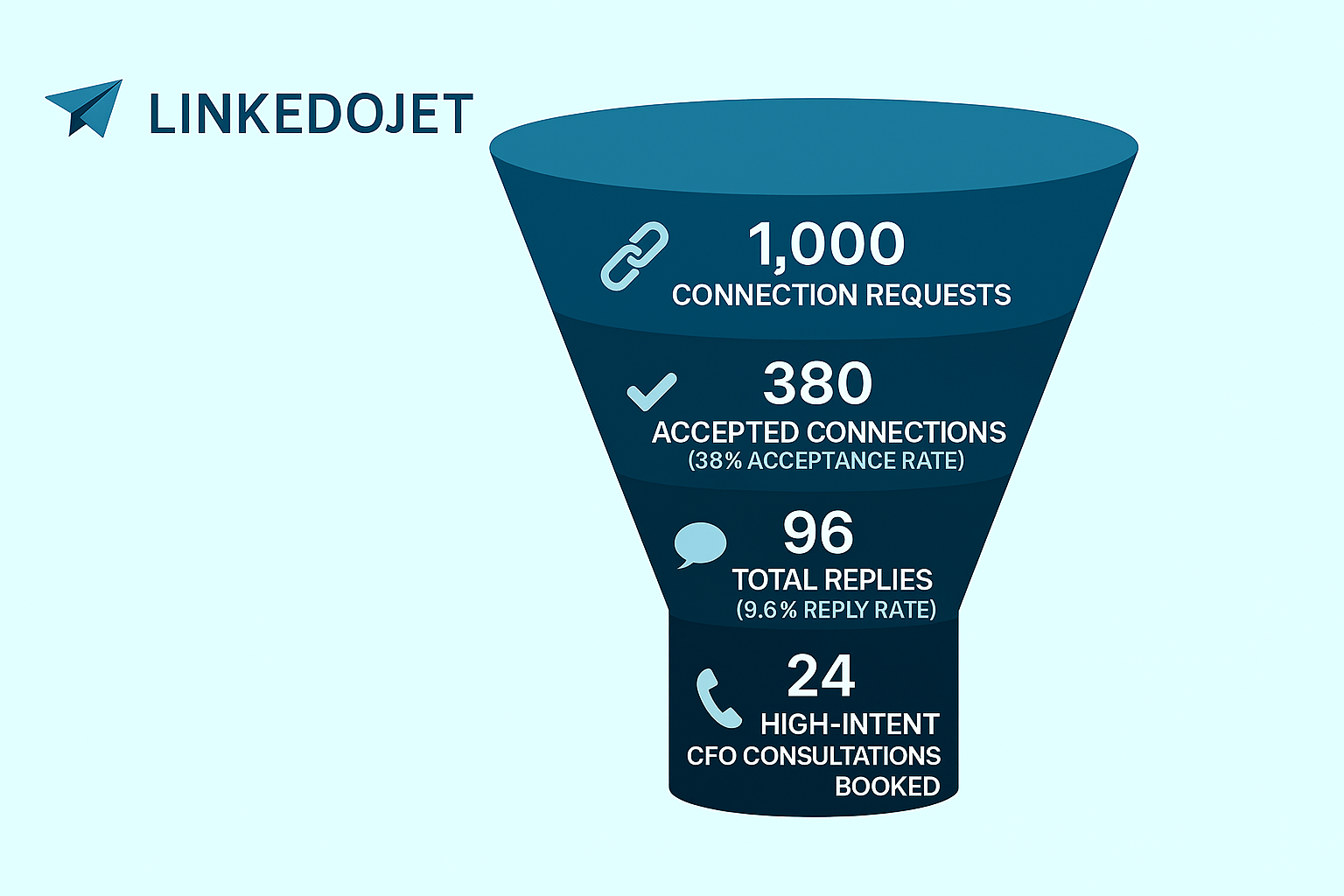

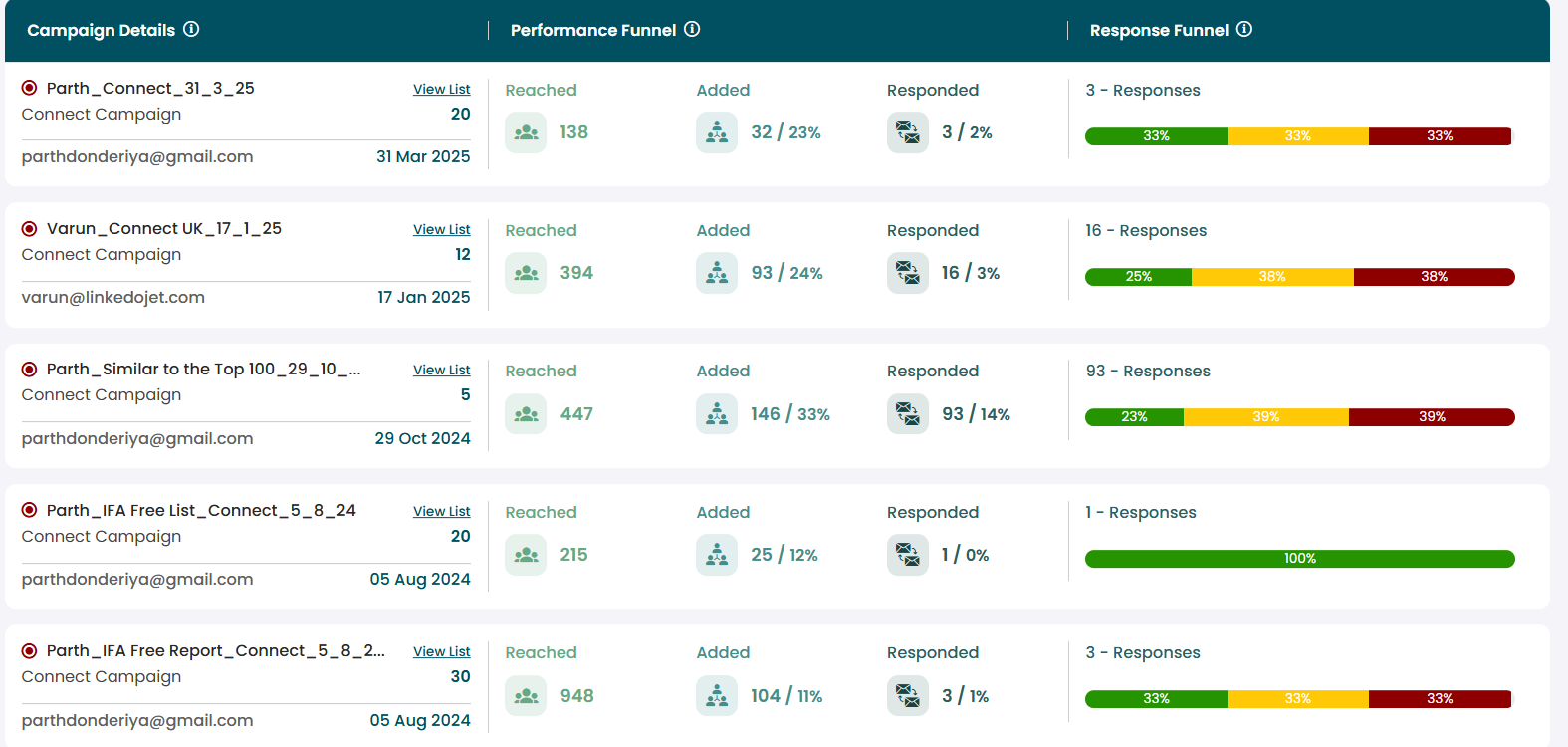

📈 Early Campaign Results

- 🔗 1,000 Connection Requests Sent

- ✅ 380 Accepted Connections (38% acceptance rate)

- 💬 96 Total Replies (9.6% reply rate)

- 📞 24 High-Intent CFO Consultations Booked

- 📊 Most Interest Shown In: FP&A Strategy, Cash Flow Management, Investor Reporting

- 🌎 Top Responding Regions: USA, UK, UAE, India, Singapore

Why Deeply Personalized LinkedIn Outreach Works

- Direct access to decision-makers: Connect directly with CEOs, founders, and investors — no gatekeepers, no long cycles.

- Conversations > Cold Pitches: Thoughtful outreach starts dialogue about financial strategy, not hard selling.

- Fast feedback loops: Quickly discover if your CFO services resonate — and refine based on real market responses.

- Turn prospects into promoters: Early trust built on finance expertise converts into referrals, testimonials, and retained clients.

AI-Powered Personalization — Beyond Templates

Modern LinkedIn Automation for CFO services goes far beyond canned templates. It tailors outreach to each company’s financial stage, challenges, and leadership structure — ensuring conversations are relevant and trusted.

With AI-powered analysis, LinkedoJet studies job titles, posts, and company activity to deliver true 1:1 LinkedIn Outreach that converts.

- Role-Specific Messaging: Approach a CEO differently from a VC-backed founder — AI captures those nuances.

- Activity Triggers: Reference funding announcements, hiring growth, or expansion posts for contextual CFO outreach.

- Company Intelligence: Personalize by stage (seed, growth, PE-backed), revenue size, or expansion goals.

- Natural Language Tuning: Messages feel like genuine insight from a finance leader — not auto-generated spam.

📌 CFO-for-Hire Example: FinWise Partners – Fractional CFO for Growth Companies

🏢 Company Overview

Name: FinWise Partners

Category: Fractional CFO & FP&A Advisory

Founded: 2021

HQ: London, UK

Website: finwisecfo.com (fictional)

What it does: Provides part-time CFO and FP&A services to scale-ups — cash flow forecasting, board reporting, fundraising support, and profitability optimization.

🎯 Ideal Customer Profile (ICP)

Persona: David Chen – Founder/CEO

Target Companies: Seed to Series C SaaS, ecommerce, fintech, and PE-backed portfolio companies

Regions: USA, UK, UAE, Singapore, India

Main Challenge: Unpredictable cash flow, weak financial reporting, difficulty preparing for investors/boards

📬 Value-Driven Outreach Sequence (Soft CTA Style)

“Fast growth feels exciting — but without forward-looking cash flow, it can stall quickly.”

Just starting a conversation — no pitch.

“82% of small businesses fail due to cash flow mismanagement.”

Shares a free 5-point cash flow audit — no pressure.

“Founders shouldn’t have to ‘fly blind’ into board meetings — numbers should build confidence, not stress.”

Helped a SaaS founder cut monthly burn by 27% while preparing a clean investor deck that secured $4M in Series A funding.

“Is Your Finance Function Investor-Ready?” — A 2-minute CFO readiness checklist. No strings attached.

📌 Outreach Example: FinWise Partners – Fractional CFO Outreach Flow

🎯 Ideal Customer Profile (ICP)

Name: Sarah Patel

Role: Founder & CEO

Company: Series B SaaS company (~200 employees)

Challenges: Preparing for fundraising, weak FP&A, cash flow unpredictability, investor reporting stress

💬 Message 1: Curiosity-Driven Connection

“Growth is great — but it gets risky fast when there’s no forward-looking cash flow plan.”

📊 Message 2: Value Drop via Stat

“82% of companies cite cash flow issues as their top financial challenge.”

🧠 Message 3: Emotional Resonance

“No founder should walk into a boardroom uncertain about their numbers.”

📚 Message 4: Transformation Story

Enabled a fintech startup to secure $4M funding after restructuring finance systems in 60 days.

✅ Message 5: Free Checklist + Soft CTA

“Is Your Finance Department Investor-Ready?” — Free 2-min CFO checklist offered.

This messaging sequence reflects the LinkedoJet principle — lead with curiosity, earn trust with insight, and only offer a CTA when the timing feels natural. Each message builds on the last to create a trusted CFO conversation.

🧾 Full Message Set

Hi Sarah,

Thanks for connecting.

I’ve been speaking with founders recently, and one recurring theme is:

“Growth looks exciting — but cash flow mismanagement can kill it overnight.”

Have you experienced this at your stage? Curious how you’re tackling cash flow planning as you scale.

No pitch — just genuinely curious.

Warm regards,

[Your Name]

Hi Sarah,

Quick stat you might find interesting:

🧠 82% of scale-ups cite cash flow visibility as their #1 financial challenge.

One of our clients improved investor trust and secured $4M funding after we rebuilt their FP&A model — all within 60 days.

If helpful, I can share our CFO readiness checklist. No pressure.

Best,

[Your Name]

🎯 Key Benefits of Personalized Outreach for CFO-for-Hire Services

🚀 Land Retained Clients, Not Just Leads

Connect directly with CEOs, founders, and investors who actually decide on hiring a Fractional or Outsourced CFO — without middle layers or long referral waits.

💬 Start Strategic Finance Conversations

Skip the generic cold pitches. Our messaging builds rapport around real challenges — like fundraising, cash flow planning, board reporting, and profitability.

📈 Validate Offers Before Scaling

Don’t waste weeks building funnels. Use LinkedIn Outreach to test your positioning (FP&A, M&A prep, investor reporting) and discover what resonates with decision-makers in real time.

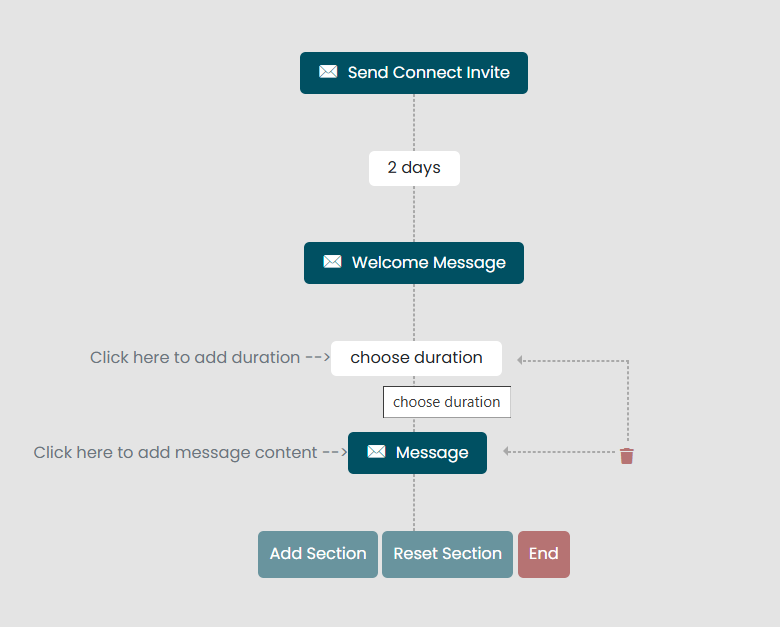

🔁 The Outreach Flow — From Connection to CFO Engagement

❓ Frequently Asked Questions

Do I need a big budget?

No. You don’t need ad spend, SDRs, or inbound funnels. Our outreach strategy is lean, AI-personalized, and designed to land high-value CFO engagements through LinkedIn Lead Generation.

How long until I see results?

Most CFO-for-Hire clients start seeing warm replies, strategy call bookings, or investor-related inquiries within 7–10 days of campaign launch.

Is this just another cold message template?

Not at all. Each message is AI-personalized using the prospect’s role, company stage, recent funding news, and even their activity — so it feels like a relevant financial conversation, not spam.

What kind of clients does this work best for?

CEOs, founders, and portfolio company operators who need strategic financial leadership: cash flow management, fundraising support, FP&A, or exit planning.

What if I’m not sure who my ideal client is yet?

That’s the best time to start. LinkedoJet helps Fractional CFOs test multiple ICPs quickly — with real-time feedback from the market instead of assumptions.

How is LinkedoJet different from tools like PhantomBuster or Dripify?

LinkedoJet isn’t just a tool — it’s a complete CFO lead generation system. We give you ICP targeting, custom messaging, AI personalization, and strategist-backed campaign support — all tracked inside a live dashboard.

📚 How to Use Your Free LinkedIn Outreach Report

- Review the tailored CFO ICP segmentation (roles, industries, company stage)

- Apply filters in LinkedIn Sales Navigator

- Use the 4-message CFO outreach sequence inside the report to start conversations

- Track replies, adjust, and iterate — feedback becomes financial strategy fuel

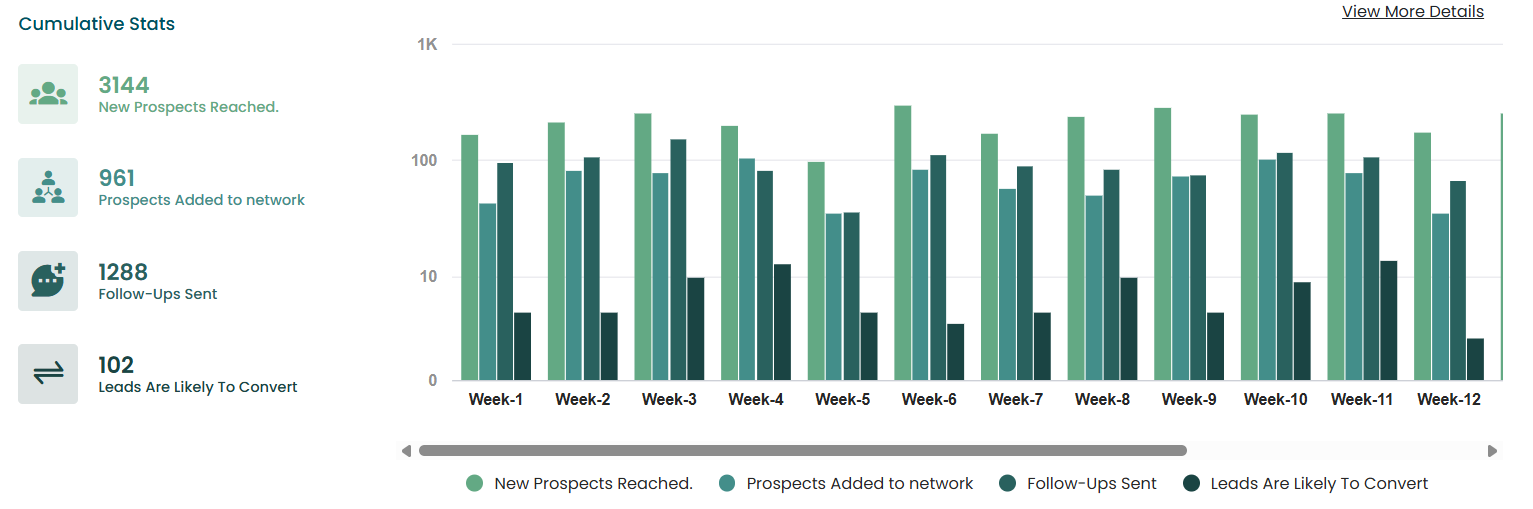

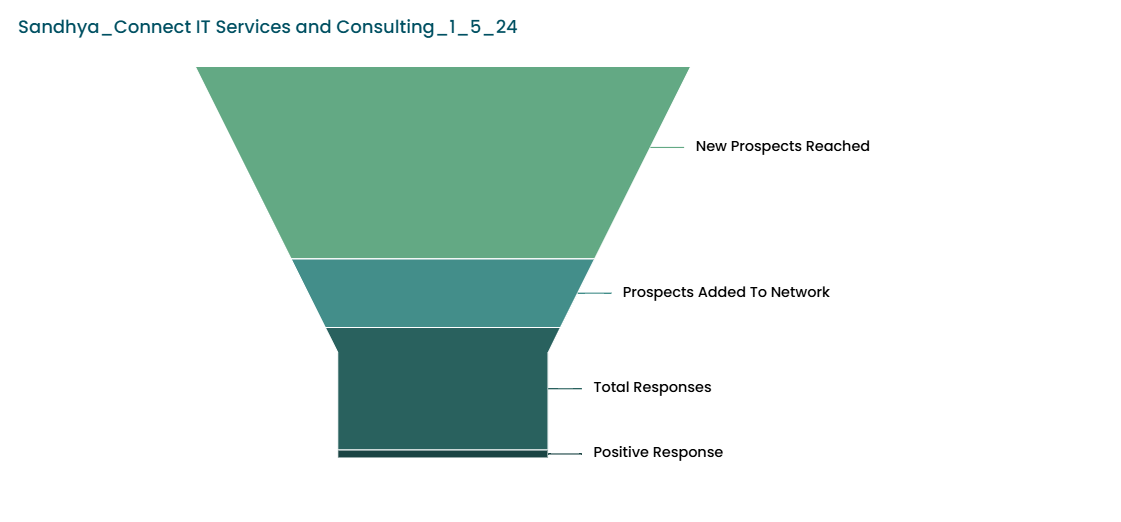

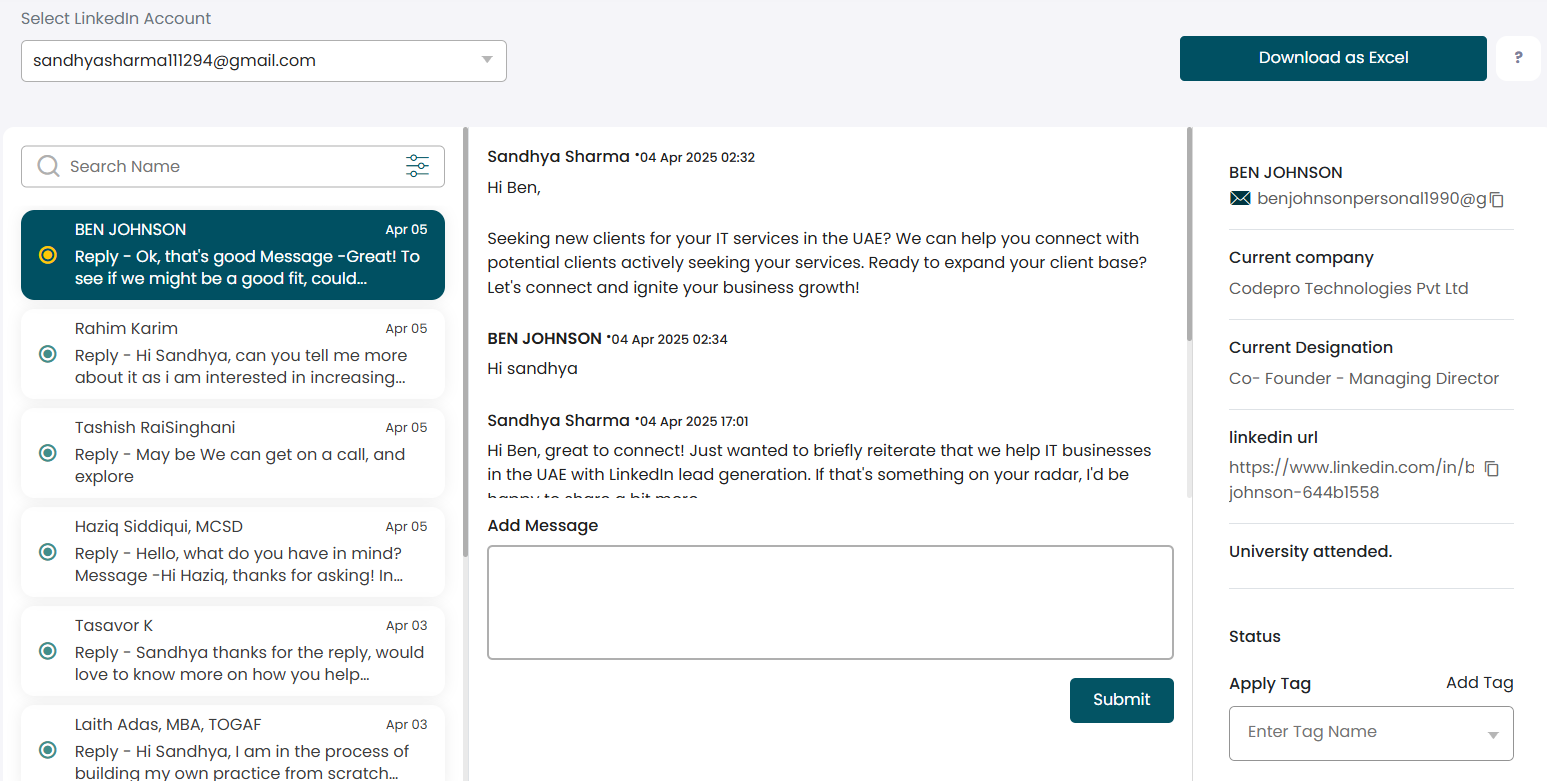

📊 Inside the LinkedoJet Dashboard

LinkedoJet is more than LinkedIn automation — it’s a CFO client acquisition system. We combine consulting-first strategy with a powerful dashboard so you can generate and track high-quality LinkedIn leads for your CFO services.

- Custom ICP Setup: Define your Ideal Client Profile across CEOs, founders, and PE-backed operators who hire CFOs.

- Message Strategy: We don’t just automate outreach — we craft finance-focused messaging that builds trust.

- Transparent Lead Tracking: Every reply, consultation, and opportunity is visible inside your dashboard.

- Consulting-Backed Delivery: You get a SaaS-powered system supported by outreach strategists who understand CFO sales cycles.