🚀 Attract High-Net-Worth Clients with LinkedIn Automation

Perfect for financial advisors, wealth managers, and investment consultants looking to connect with affluent clients, build trust, and grow AUM without relying on cold calls or seminars. Free Custom Report (worth $100) included.

Claim Free Report Book a Free Strategy CallWhy Financial Advisors Need Outreach First A Real Story

For most financial advisors, relying solely on referrals or local networking events isn't enough anymore. High-net-worth individuals are busy and your ideal clients aren’t browsing financial forums or walking into offices uninvited.

That’s when we shifted to LinkedIn automation. Not spammy messages but smart, personalized outreach to CEOs, senior executives, and global professionals looking for wealth strategies, retirement plans, or diversification options.

The result? More conversations in 30 days than an entire year of passive marketing real discussions with decision-makers who actually wanted to talk about their future.

Now, we help financial advisors, IFAs, and wealth managers do the same using a system designed to spark trust, generate inbound interest, and grow AUM with qualified leads.

If your calendar feels empty and your referrals aren’t scaling, LinkedIn outreach is where modern client acquisition begins.

Who Is This Outreach Strategy Built For?

- Independent Financial Advisors Who want to attract high-net-worth individuals through direct, personalized outreach on LinkedIn.

- Wealth Managers & Investment Consultants Looking to build relationships with senior executives, entrepreneurs, and affluent families.

- Cross-Border & Offshore Advisory Experts Targeting expats and global professionals seeking portfolio diversification or residency planning.

- Firms Offering Retirement & Tax Planning Services Wanting to connect with professionals preparing for succession or early retirement.

- Boutique Financial Planning Firms Focused on delivering white-glove service to clients with complex financial needs.

🎯 What Makes LinkedoJet Different from other Outreach tools?

Most LinkedIn tools stop at automation. LinkedoJet delivers a fully managed outreach system that helps financial advisors consistently connect with high-net-worth individuals and grow their client base.

- End-to-End Client Acquisition System We go beyond software. Our team builds your ideal client profile (ICP), crafts strategic messaging, and runs your campaign from start to finish.

- LinkedIn Automation for Financial Advisors Reach affluent professionals and executives with personalized messages that feel human and relevant — never robotic.

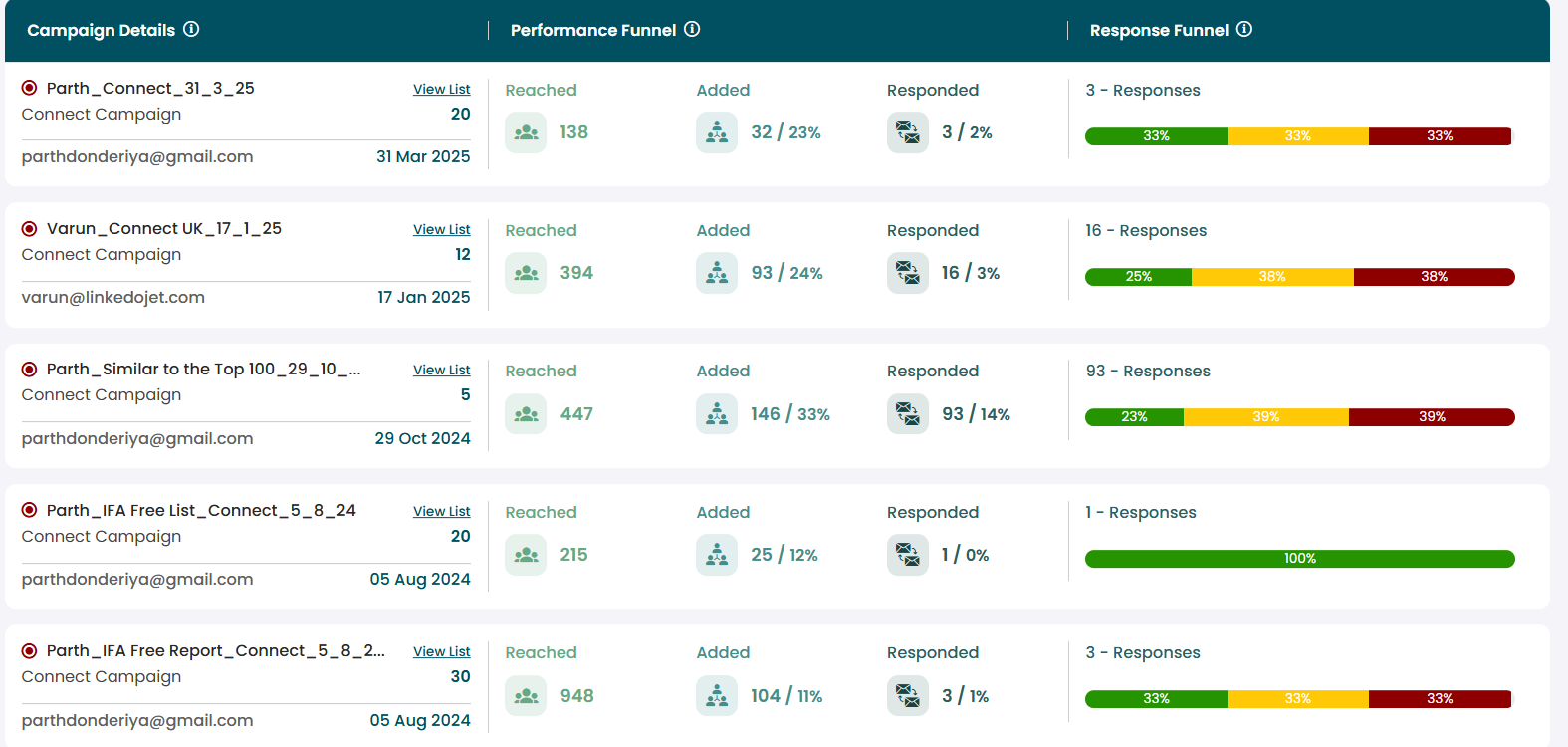

- Live Campaign Dashboard Monitor every reply, connection, and call booked in real time through a clean, transparent dashboard.

- AI-Powered Personalization Messages are tailored using AI that understands your prospect’s role, interests, and behavior on LinkedIn.

- Ongoing Support from Outreach Experts We optimize your campaign week by week, fine-tuning your pitch and message flow based on real campaign data.

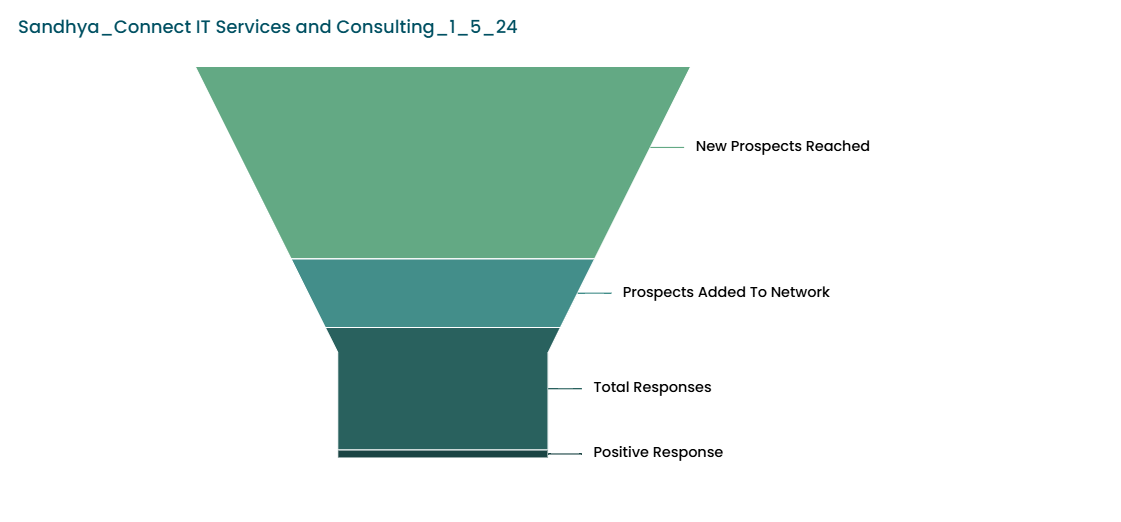

📈 Early Campaign Results – Financial Advisory Edition

- 🔗 1,000 Connection Requests Sent

- ✅ 380 Accepted Connections (38% acceptance rate)

- 💬 95 Total Replies (25% reply rate on accepts)

- 👍 48 Positive Replies (≈50% of replies)

- 📞 10–12 Discovery Calls Booked (≈22–25% of positive replies)

Why Deeply Personalized LinkedIn Outreach Works

Affluent professionals, senior executives, and business owners receive countless generic LinkedIn messages. What gets their attention isn’t volume — it’s relevance, credibility, and timing.

That’s why we focus on deep personalization powered by AI and financial insight — every message is tailored to reflect the prospect’s financial goals, career stage, and market context.

- Role-specific financial concerns (e.g. retirement planning, capital preservation, asset diversification)

- Industry-specific insight that shows you understand their world (e.g. compensation trends, exit strategies, or international planning)

- Behavioral signals from their posts, activity, or job changes that make each outreach timely and relevant

AI-Powered Personalization – Beyond Templates

Most outreach tools use recycled templates and first-name insertions. That may work for cold sales, but it falls flat with high-net-worth individuals who expect discernment and relevance.

LinkedoJet uses an AI-powered personalization engine designed to craft messages that align with your prospect’s wealth stage, interests, and behavioral signals.

- Persona-Specific Messaging (e.g. CXO nearing retirement vs young tech founder vs global expat)

- Recent Activity and Tone (LinkedIn posts, engagement with financial topics, life milestones)

- Company Role and Career Signals (equity holders, leadership transitions, startup exits)

- Geographic and Tax Planning Context (UAE residency, India-NRI dynamics, UK pension concerns)

📌 Financial Advisory Example: Ascend Wealth – Private Client Advisory

🏢 Company Overview

Name: Ascend Wealth

Category: Financial Advisory & Wealth Management

Founded: 2018

HQ: Dubai, UAE

Website: ascendwealthgroup.com (fictional)

What it does: Offers private wealth planning, investment advisory, and

cross-border financial strategies to HNWIs and senior professionals across UAE, UK, and

India.

🎯 Ideal Customer Profile (ICP)

Persona: Rajiv Mehta – 52, Senior VP at a Global Pharma Firm

Target Audience: HNWIs, CXOs, entrepreneurs, and NRI expats

Regions: UAE, India, UK, Singapore

Main Challenge: Navigating wealth protection, retirement readiness, and

cross-border tax complexities

📬 Value-Driven Outreach Sequence

Hi Rajiv,

Many professionals I speak with are confident earners — but still feel uncertain about

where their money actually works best.

Just curious — have you come across this lately?

(No pitch. Just an open conversation.)

Hi Rajiv,

Thought I’d share a quick read: “5 Triggers That Quietly Disrupt Long-Term Wealth

Plans.”

Happy to send it over if it’s helpful — we put it together for clients navigating

similar stages.

Hi Rajiv,

One client told me recently, “It’s not about returns. It’s about peace of

mind.”

That stuck with me. Most of our work is helping people simplify and align with what

truly matters.

Curious how you think about that balance.

We helped a senior executive relocate from the UK to UAE — structured his assets for tax

efficiency and future legacy planning.

If that’s ever on your radar, I’d be happy to share what worked.

We recently created a 2-minute “Wealth Planning Readiness Checklist.”

If you’d like early access, I’ll share it — no obligation, just useful thinking points

we give new clients.

🎯 Key Benefits of Personalized Outreach

🏦 Direct Access to HNWIs

Connect with high-net-worth individuals and expats without relying on ads or cold databases.

💬 Meaningful Conversations

Build trust with tailored outreach that speaks to their financial goals and lifestyle aspirations.

📊 Real-Time Market Insights

Understand objections and interests to refine your wealth advisory approach.

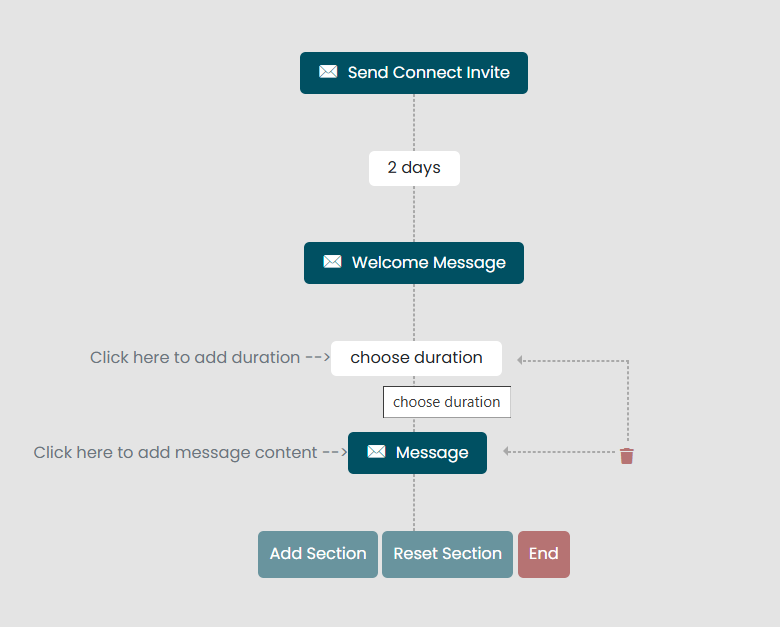

🔁 The Outreach Flow — From LinkedIn to Qualified Wealth Leads

❓ Frequently Asked Questions

Do I need a big budget?

No. Our approach is lean and doesn't rely on paid ads or expensive seminars to get traction. It’s designed for relationship-driven client acquisition.

How long until I see results?

Most advisors begin seeing qualified conversations and discovery call bookings within the first 7 to 14 days of launching outreach.

Is this just a cold message template?

Not at all. Every message is customized using AI and behavioral signals — based on the prospect’s role, activity, and stage of wealth planning.

Will this work in a regulated industry like wealth management?

Yes. Our messaging is designed to comply with best practices in financial services — no product pitches or unsolicited offers. We focus on conversation and value-led insights.

Can this work for cross-border clients or NRI expats?

Absolutely. Many of our financial clients target expatriates or global professionals. We tailor filters and messaging for regions like UAE, India, UK, and Singapore.

What if I already have a strong referral network?

That's great — this system complements your referrals by creating new conversations with clients outside your existing circle, especially on LinkedIn.

What happens after someone replies?

We guide you on how to move the conversation forward, from soft insights to setting up a discovery call. You can also track replies and performance in your dashboard.

📚 How to Use Your Free LinkedIn Outreach Report

- Review the tailored ICP segmentation (roles, industries, keywords)

- Apply filters in LinkedIn Sales Navigator

- Use the 4-message sequence inside the report to start outreach

- Track replies, adjust, and iterate feedback = fuel

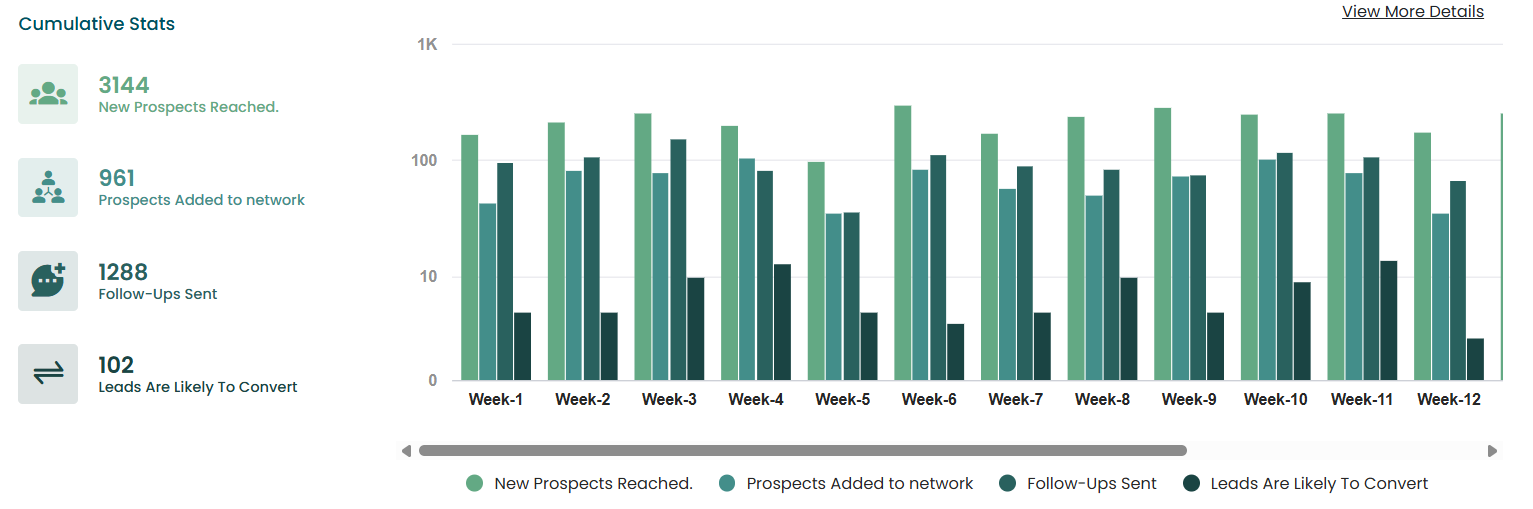

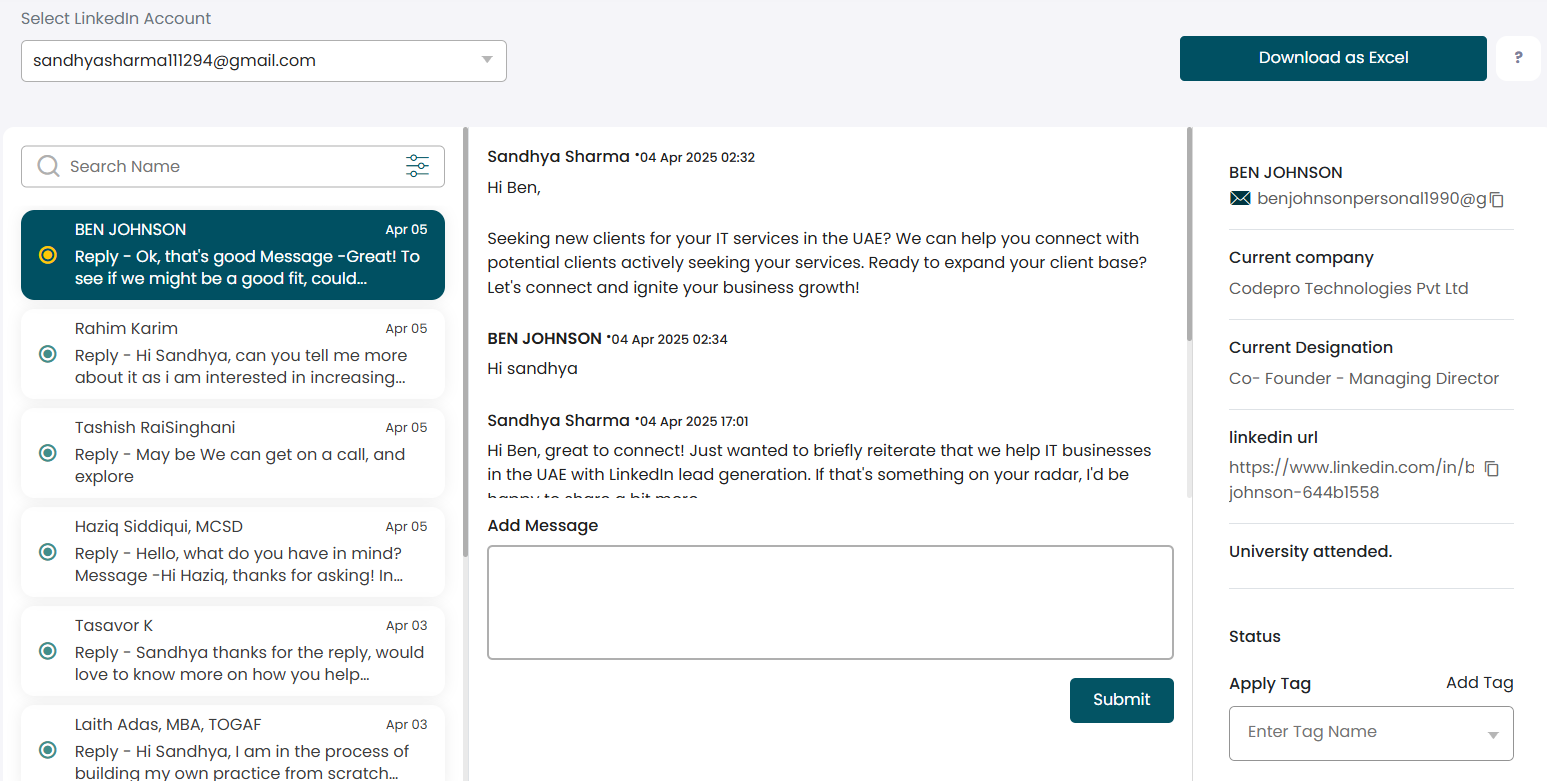

📊 Inside the LinkedoJet Dashboard

LinkedoJet is more than a LinkedIn automation tool — it’s a full-stack outreach system. We combine a consulting-first approach with a powerful dashboard to help you generate and track qualified leads at every step.

- Custom ICP Setup: We work with you to define your Ideal Customer Profile based on real buyer data.

- Message Strategy: We don’t just automate outreach — we craft story-led messaging for every persona.

- Transparent Lead Tracking: Every reply, conversion, and metric is visible on your dashboard.

- Consulting-Backed Delivery: You get a SaaS system with a team of outreach strategists behind it.